Archives

- By thread 5363

-

By date

- June 2021 10

- July 2021 6

- August 2021 20

- September 2021 21

- October 2021 48

- November 2021 40

- December 2021 23

- January 2022 46

- February 2022 80

- March 2022 109

- April 2022 100

- May 2022 97

- June 2022 105

- July 2022 82

- August 2022 95

- September 2022 103

- October 2022 117

- November 2022 115

- December 2022 102

- January 2023 88

- February 2023 90

- March 2023 116

- April 2023 97

- May 2023 159

- June 2023 145

- July 2023 120

- August 2023 90

- September 2023 102

- October 2023 106

- November 2023 100

- December 2023 74

- January 2024 75

- February 2024 75

- March 2024 78

- April 2024 74

- May 2024 108

- June 2024 98

- July 2024 116

- August 2024 134

- September 2024 130

- October 2024 141

- November 2024 171

- December 2024 115

- January 2025 216

- February 2025 140

- March 2025 220

- April 2025 233

- May 2025 239

- June 2025 303

- July 2025 176

-

Gen AI and workers: What you should know

On Point

Industries that could be most affected

by "McKinsey On Point" <publishing@email.mckinsey.com> - 01:41 - 27 Oct 2023 -

Beyond ‘quiet luxury,’ gen AI and the future of work, Tech for Execs, and more: The Daily Read weekender

Unwind and catch up on the week's big reads Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

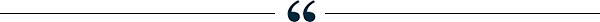

TECH FOR EXECS

Our experts serve up a periodic look at the technology concepts leaders need to understand to help their organizations grow and thrive in the digital age.

What it is. Explainable AI (XAI) refers to the ability to understand how an AI-powered application arrived at a particular output. Thanks to complex algorithms in AI applications, this isn’t easy. But doing so is foundational to managing risks and ensuring that an AI application performs optimally.

Why we need it. While the neural networks running behind many AI apps are loosely modeled after the human brain, they often don’t process data in the ways that humans do. But if we can’t understand how AI arrived at a particular conclusion, how can skeptical users trust the results enough to take actions on them? XAI has business implications as well. It can help data scientists figure out why an app might be producing biased or inaccurate recommendations. Also, if regulators want proof that bias isn’t occurring—a mounting concern as more governments consider AI regulations—XAI makes it easier to provide that proof.

How to make AI interpretable. Data scientists are applying a number of “explainability” features—including local interpretable model-agnostic explanations (LIME) and Shapley additive explanations (SHAP)—to illuminate which data most influence an AI’s decisions. Still, only 25 percent of organizations enable XAI. Is your AI interpretable? Simple, easily interpretable algorithms often suffice, but when complexity is required, applying explainability techniques should become standard practice.QUOTE OF THE DAY

chart of the day

Ready to unwind?

—Edited by Joyce Yoo, editor, New York

Share these insights

Did you enjoy this newsletter? Forward it to colleagues and friends so they can subscribe too. Was this issue forwarded to you? Sign up for it and sample our 40+ other free email subscriptions here.

This email contains information about McKinsey’s research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to our McKinsey Quarterly Five Fifty alert list.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Daily Read" <publishing@email.mckinsey.com> - 12:18 - 27 Oct 2023 -

Learn the can’t-miss guiding principles for successful GenAI initiatives.

Learn the can’t-miss guiding principles for successful GenAI initiatives.

Learn requirements and architectural approaches to domain-specific LLMs for GenAI.

Navigate the Next Wave of GenAI:

Domain-Specific LLMsThursday, November 9, 2023

10:00am – 11:00am PSTRegister for the webinar

Stay at the Forefront of Innovation

Join our new GenAI webinar series to learn about the latest trends and best practices in generative AI from industry leaders and practitioners.

Navigate the Next Wave of GenAI: Domain-Specific LLMs

To gain competitive advantage, innovative companies are starting to embed large language models into proprietary workflows that support domain-specific use cases. Many of them choose open-source LLMs to reduce data and compute requirements as well as privacy risks. The results have the potential to accelerate and enrich all sorts of business functions, from customer service to document processing and more.

Join our discussion with Kevin Petrie, VP of Research at Eckerson Group, and Ro Shah, AI Product Director at Intel, to better understand how careful design, implementation, and governance will help you achieve success with the next of GenAI.

Topics include:

- The requirements and architectural approaches to domain-specific LLMs

- Common challenges, benefits, and use cases

- Must-know guiding principles for successful generative AI initiatives

Thursday, November 9, 2023 10:00am – 11:00am PST

Register for the webinar

Kevin Petrie

VP of Research at Eckerson Group

Ro Shah

AI Product Director at Intel's Data Center and AI Group

Sancha Huang Norris

Generative AI Marketing Lead at Intel's Data Center and AI Business Unit

If you forward this email, your contact information will appear in any auto-populated form connected to links in this email.

This was sent to info@learn.odoo.com because you are subscribed to Webinars. To view and manage your marketing-related email preferences with Intel, please click here.

© 2023 Intel Corporation

Intel Corporation, 2200 Mission College Blvd., M/S RNB4-145, Santa Clara, CA 95054 USA. www.intel.com

Privacy | Cookies | *Trademarks | Unsubscribe | Manage Preferences

by "Intel Corporation" <intel@plan.intel.com> - 04:02 - 26 Oct 2023 -

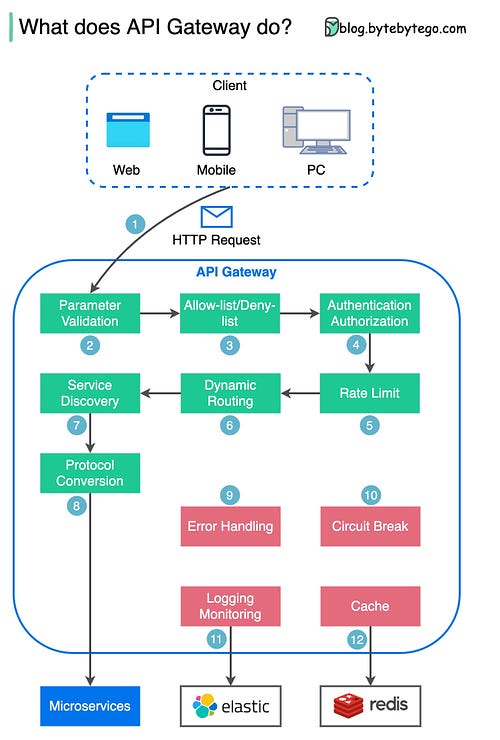

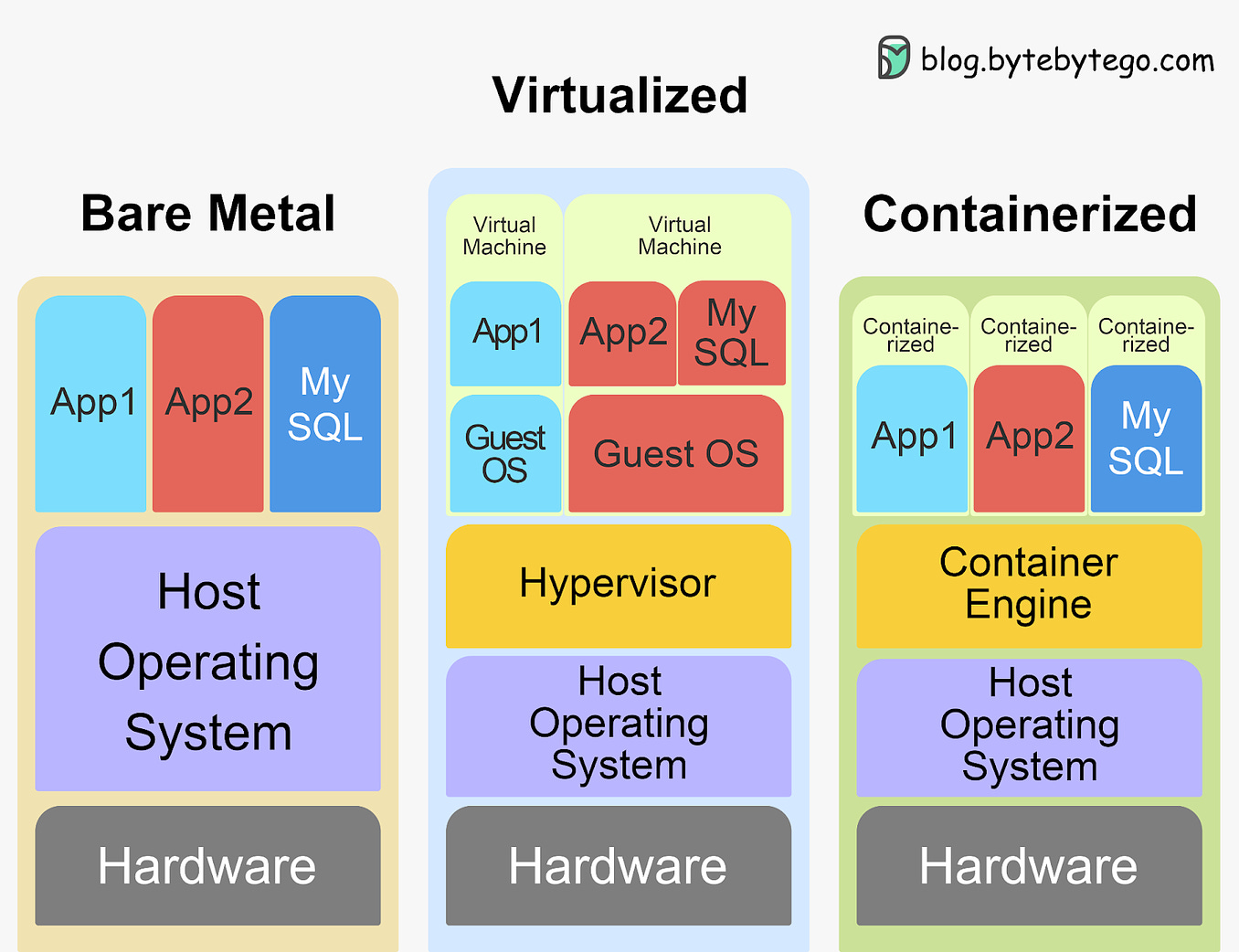

A Crash Course in Kubernetes

A Crash Course in Kubernetes

In today's world of complex, web-scale application backends made up of many microservices and components running across clusters of servers and containers, managing and coordinating all these pieces is incredibly challenging. That's where Kubernetes comes in. Kubernetes (also known as "k8s") is an open-source container orchestration platform that automates deployment, scaling, and management of containerized applications. Forwarded this email? Subscribe here for moreThis is a sneak peek of today’s paid newsletter for our premium subscribers. Get access to this issue and all future issues - by subscribing today.

Latest articles

If you’re not a subscriber, here’s what you missed this month.

The 6 Most Impactful Ways Redis is Used in Production Systems

The Tech Promotion Algorithm: A Structured Guide to Moving Up

To receive all the full articles and support ByteByteGo, consider subscribing:

In today's world of complex, web-scale application backends made up of many microservices and components running across clusters of servers and containers, managing and coordinating all these pieces is incredibly challenging.

That's where Kubernetes comes in. Kubernetes (also known as "k8s") is an open-source container orchestration platform that automates deployment, scaling, and management of containerized applications.

With Kubernetes, you don't have to worry about manually placing containers or restarting failed ones. You simply describe your desired application architecture and Kubernetes makes it happen and keeps it running.

In this two-part series, we'll dive deep into Kubernetes and cover:

Key concepts like pods, controllers, and services

The components that make up a Kubernetes cluster

When and why Kubernetes is useful for your applications

Tradeoffs to consider before adopting Kubernetes

We'll demystify Kubernetes and equip you with everything you need to determine if and when Kubernetes could be the right solution for your applications. You'll walk away with a clear understanding of what Kubernetes is, how it works, and how to put it into practice.

Whether you're a developer, ops engineer, or technology leader, you'll find invaluable insights in this deep dive into Kubernetes. Let's get started!

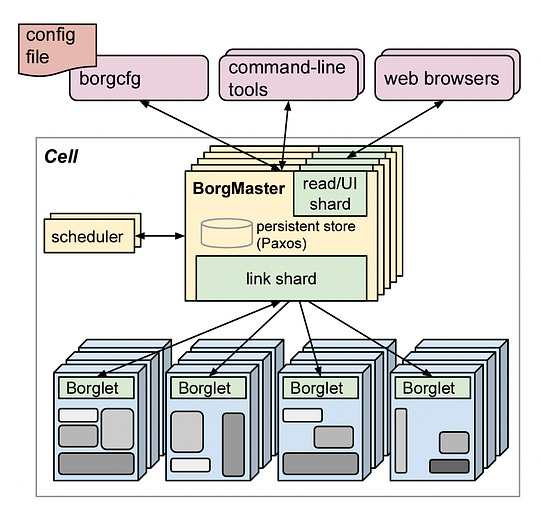

Brief History

Kubernetes can be traced back to Google's internal container orchestration system, Borg, which managed the deployment of thousands of applications within Google. Containers are a method of packaging and isolating applications into standardized units that can be easily moved between environments. Unlike traditional virtual machines (VMs) which virtualize an entire operating system, containers only virtualize the application layer, making them more lightweight, portable and efficient.

In 2014, Google open-sourced a container orchestration system based on its learnings from Borg. This is Kubernetes. Kubernetes provides automated deployment, scaling and management of containerized applications. By leveraging containers rather than VMs, Kubernetes provides benefits like increased resource efficiency, faster deployment of applications, and portability across on-prem and cloud environments.

Why is it also called k8s? This is a somewhat nerdy way of abbreviating long words. The number 8 in k8s refers to the 8 letters between the first letter “k” and the last letter “s” in the word Kubernetes.

Kubernetes Architecture and Key Components

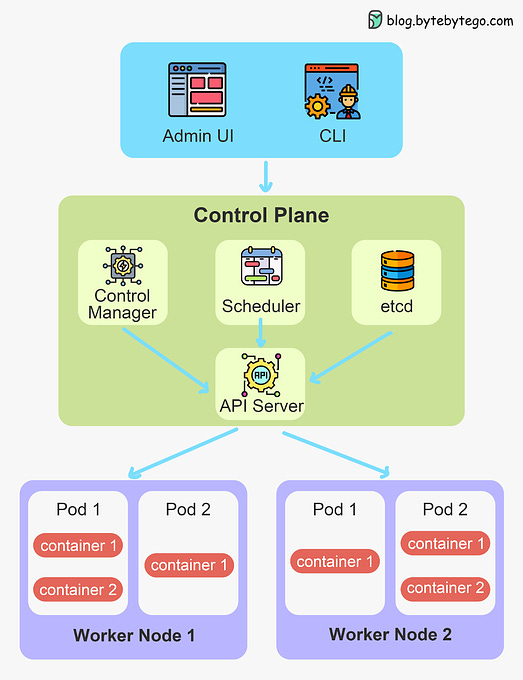

At its core, Kubernetes follows a client-server architecture. There are two core pieces in a Kubernetes cluster - control plane and worker nodes.

The control plane is responsible for managing the state of the cluster. In production environments, the control plane usually runs on multiple nodes that span across several data center zones.

In other words, the control plane manages worker nodes and the containers running on them.

The containerized applications run in a Pod. Pods are the smallest deployable units in Kubernetes. A pod hosts one or more containers and provides shared storage and networking for those containers. Pods are created and managed by the Kubernetes control plane. They are the basic building blocks of Kubernetes applications.

Let’s dive deeper into the main pieces.

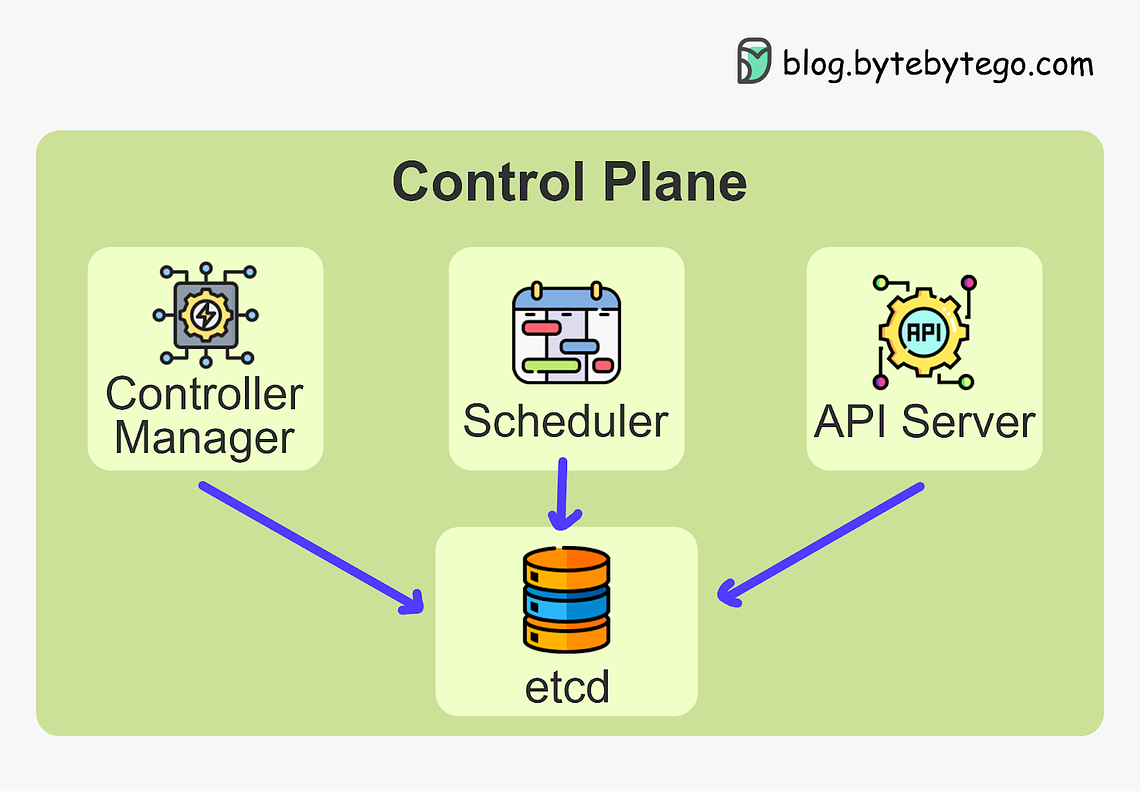

Kubernetes Control Plane

The control plane is the brain of Kubernetes. It consists of various components that, together, make global decisions about the cluster. The control plane components run on multiple servers across availability zones to provide high availability.

The key components are:

Kubernetes API Server

Etcd

Kubernetes Scheduler

Kubernetes Controller Manager

Keep reading with a 7-day free trial

Subscribe to

ByteByteGo Newsletterto keep reading this post and get 7 days of free access to the full post archives.A subscription gets you:

An extra deep dive on Thursdays Full archive Many expense it with team's learning budget Like

Comment

Restack

© 2023 ByteByteGo

548 Market Street PMB 72296, San Francisco, CA 94104

Unsubscribe

by "ByteByteGo" <bytebytego@substack.com> - 11:38 - 26 Oct 2023 -

3 steps to platform engineering mastery

3 steps to platform engineering mastery

Equip yourself with the knowledge and strategies needed to master platform engineering and API architecture.The road to API-Topia: A platform engineer’s handbook

We're thrilled to present our latest expert guide, The road to API-Topia: A platform engineer’s essential handbook, created in collaboration with industry expert James Higginbotham.

If you're ready to:

- Enhance your team's productivity.

- Streamline development processes.

- Master the art of efficient platform engineering...

This is the ultimate back-pocket resource you need to thrive in a new era of software development. Your journey towards success begins now!

See you there!

TykTyk, 87a Worship Street, London, City of London EC2A 2BE, United Kingdom, +44 (0)20 3409 1911

by "Tyk" <communities@tyk.io> - 09:47 - 26 Oct 2023 -

[eBook] How to take infrastructure monitoring to the next level

New Relic

The paradox of infrastructure monitoring is that the more mission-critical it becomes, the more complex it becomes to monitor and manage.

The paradox of infrastructure monitoring is that the more mission-critical it becomes, the more complex it becomes to monitor and manage.

DevOps and SRE teams face a sprawling network of complex systems and changing environments. This increasingly complex software infrastructure is now more critical to business success than it’s ever been. A mixed bag of metrics from a disconnected set of tools isn’t sufficient in today’s environment.

With observability, you can proactively collect, visualize, and apply intelligence to all of your metrics, events, logs, and traces in order to gain a holistic understanding of your entire software system.

How do you get there? In our eBook, we’ll look at four ways that DevOps and SRE teams can achieve true observability.

Download Ebook Need help? Let's get in touch.

This email is sent from an account used for sending messages only. Please do not reply to this email to contact us—we will not get your response.

This email was sent to info@learn.odoo.com Update your email preferences.

For information about our privacy practices, see our Privacy Policy.

Need to contact New Relic? You can chat or call us at +44 20 3859 9190.

Strand Bridge House, 138-142 Strand, London WC2R 1HH

© 2023 New Relic, Inc. All rights reserved. New Relic logo are trademarks of New Relic, Inc

Global unsubscribe page.

by "New Relic" <emeamarketing@newrelic.com> - 05:36 - 26 Oct 2023 -

Measuring software developer productivity is indeed possible

On Point

Four key steps to get started Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

•

Speedier code. Developers are embracing generative AI (gen AI) tools, which may be applied throughout the stages of software development. Gen AI platforms can suggest applications, propose code, and produce written documentation. In a study of 95 programmers, the developers who used a gen-AI-based tool were able to complete a task significantly faster than the group that did not. This suggests that such technologies could improve software developers’ overall output and boost the performance of less experienced coders. [Brookings]

•

Measuring productivity. Many leaders think that it’s not possible to measure software developers’ productivity. But with most companies becoming, to an extent, software companies, executives must know that they are using talent effectively, McKinsey senior partner Chandra Gnanasambandam and coauthors say. Software development is complex, creative work that requires tracking multiple metrics. To help overcome these challenges, McKinsey developed a way to evaluate developer productivity that is easier to implement with surveys or existing data.

— Edited by Belinda Yu, editor, Atlanta

Introducing Insights to Impact

Be among the first to subscribe to this free newsletter delivering a weekly roundup of analysis that’s influencing decision makers. Each Friday, we’ll offer insights across geographies, industries, and capabilities to help leaders identify new opportunities to spur innovation and growth, sustainably.

Click to subscribeThis email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the On Point newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey On Point" <publishing@email.mckinsey.com> - 02:24 - 26 Oct 2023 -

Press the Easy Button - A Log Analytics Buyer's Guide

Sumo Logic

(Free Download) Get the guide today

Master your log analytics. Master your business opportunities.

As log data expands, log management and analytics solutions continue to evolve. Keeping up with industry offerings can be a challenge, so we've created the Log management and analytics buyer's guide to help you find the right fit among modern solution offerings.

Learn more about Sumo Logic and the infinite power of log analytics.Sumo Logic, Level 9, 64 York Street, Sydney, NSW 2000

© 2023 Sumo Logic, All rights reserved.Unsubscribe

by "Sumo Logic" <marketing-info@sumologic.com> - 09:00 - 25 Oct 2023 -

SmartWaste - Advanced Waste Management Software that is designed to collect and manage multiple types of Waste.

SmartWaste - Advanced Waste Management Software that is designed to collect and manage multiple types of Waste.

Grow sustainable waste collection businesses with SmartWaste Software.Plan optimum waste collection and disposal routes to maximize productivity.

Benefits

Grow sustainable waste collection businesses with SmartWaste Software.

Uffizio Technologies Pvt. Ltd., 4th Floor, Metropolis, Opp. S.T Workshop, Valsad, Gujarat, 396001, India

by "Sunny Thakur" <sunny.thakur@uffizio.com> - 08:00 - 25 Oct 2023 -

Run payroll beyond borders: Expanding Global Payroll

Run payroll beyond borders: Expanding Global Payroll

Run multi-country payroll in minutes, with confidenceEarlier this year, we began rolling out Global Payroll - giving employers the confidence to run multi-country payroll with our modern platform and expert support.

Today, we're excited to expand Global Payroll to support compliant payroll processing in economic centers across Asia-Pacific, EMEA, Latin America, and North America.

In-house worldwide payroll expertise

Use Remote to consolidate global payroll across the top countries for tech talent around the world.

Plus, we're continuing to expand support for more countries over the coming months, including Brazil, Hong Kong, Israel, and Japan.

Consolidating multi-country payroll is simple with Remote

Compliant payroll, expert support, transparent pricing

Unite payroll processing across multiple countries to pay domestic and international team members from one simple hub - for one simple fee.

-

Reduce costs by centralizing payroll management

-

Ensure local compliance for every country

-

Direct support from in-house local payroll experts

-

Accurate, on-time, compliant payroll to level-up your employee experience

-

Tax and labor authority reporting handled for you

Request a demo today to see how you can save time, effort, and money with Remote Global Payroll.

You've got questions?

We've got answers.

Save time with 24/7 access to Remote’s Help Center.

You received this email because you are subscribed to News & Offers from Remote Technology, Inc.

Update your email preferences to choose the types of emails you receive.

Unsubscribe from all future emailsRemote Technology, Inc.

Copyright © 2023 Remote Technology, Inc. All rights reserved.

18 Bartol St. #1163 San Francisco California

by "Remote" <hello@remote-comms.com> - 07:02 - 25 Oct 2023 -

-

Working parents are often in critical roles. How can companies better support them?

On Point

Research on working families’ experiences Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

•

‘Fix the structure.’ Seeing millions of women exit the workforce made Reshma Saujani, the founder of Girls Who Code and the founder and CEO of the Marshall Plan for Moms, realize that making it possible for women to be moms and to work requires a different approach. “We have to stop trying to fix the woman and instead fix the structure,” says Saujani. That means paid leave, affordable childcare, and flexibility, adds Saujani, who joined McKinsey Global Institute director Kweilin Ellingrud and partner Kunal Modi on an episode of McKinsey’s Future of America podcast.

— Edited by Belinda Yu, editor, Atlanta

Introducing Insights to Impact

Be among the first to subscribe to this free newsletter delivering a weekly roundup of analysis that’s influencing decision makers. Each Friday, we’ll offer insights across geographies, industries, and capabilities to help leaders identify new opportunities to spur innovation and growth, sustainably.

Click to subscribeThis email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the On Point newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey On Point" <publishing@email.mckinsey.com> - 02:47 - 25 Oct 2023 -

ล็อคอิน mySchneider Program วันนี้ รับเลย 1,000 พอยท์!!

Schneider Electric

ล็อคอิน mySchneider วันนี้รับพ้อยเลย!!ล็อคอิน mySchneider Program วันนี้ รับเลย 1,000 พอยท์!!ข่าวด่วน !!! สำหรับสมาชิก mySchneider Program ทุกท่าน ! วันนี้ชไนเดอร์ใจดี อยากแจก

เพียงแค่ทำตามขั้นตอน ดังนี้

ขั้นตอนที่1 ล็อคอินเข้าระบบ ด้วย username และ password ของท่าน

ขั้นตอนที่2 คลิกแถบด้านบน ที่เขียนว่า "โปรแกรม" หรือ "Program"

ขั้นตอนสุดท้าย กด "enroll" หรือลงทะเบียน ในกล่อง ที่เขียนว่า IT Solution Provider

เพียงเท่านี้ก็รอรับ แต้ม จาก myReward 1,000 แต้ม เพื่อนำไปแลกของสัมนาคุณสุดฮิปได้เลยทันที !!!+ Lifecycle Services From energy and sustainability consulting to optimizing the life cycle of your assets, we have services to meet your business needs. Schneider Electric

46 Rungrojthanakul Building. 1st, 10th, 11th Floor, Ratchadapisek Road. Huaykwang

Bangkok - 10310, Thailand

Phone +662 617 5555© 2023 Schneider Electric. All Rights Reserved. Schneider Electric is a trademark and the property of Schneider Electric SE, its subsidiaries and affiliated companies. All other trademarks are the property of their respective owners.

by "Schneider Electric" <reply@se.com> - 11:01 - 24 Oct 2023 -

How will generative AI affect your workforce?

Five Fifty

Get your briefing Historically, automation has affected workers with lower education and skill levels. Generative AI is flipping the script: more-educated workers will likely experience the greatest degree of impact, say McKinsey’s Michael Chui and coauthors.

Share these insights

Did you enjoy this newsletter? Forward it to colleagues and friends so they can subscribe too. Was this issue forwarded to you? Sign up for it and sample our 40+ other free email subscriptions here.

This email contains information about McKinsey’s research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to our McKinsey Quarterly Five Fifty alert list.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Quarterly Five Fifty" <publishing@email.mckinsey.com> - 04:03 - 24 Oct 2023 -

Join me on Thursday to learn how to maximise observability with New Relic Logs

Hi MD,

Liam, Manager of Customer Training at New Relic University, here.

Are you getting the most from your log data when it comes to troubleshooting and observability? Are they easy-to-use or access when you need them?

If you'd like to improve how you use and work with your logs, you can register to attend the free online workshop I'll be hosting on Thursday 26th October at 10am BST/ 11am CEST- Maximising Observability with New Relic Logs. This 90-minute workshop will walk you through the different ways to bring log data to New Relic, the fast and easy to use UI, as well as parsing, filtering, or dropping logs to match your needs. With hands-on labs in a sandbox environment, you’ll get to search log data with ease and speed, work with partitions and AI log patterns, troubleshoot errors in applications and trace data, create charts and dashboards to share with teams, and set up alert conditions for problems you want to prevent.

You can find the full agenda on the registration page here. While we recommend attending the hands-on workshop live, you can also register to receive the recording.

I hope to see you then,

Liam Hurrell,Manager, Customer Training

This email was sent to info@learn.odoo.com as a result of subscribing or providing consent to receive marketing communications from New Relic. You can tailor your email preferences at any time here.Privacy Policy © 2008-23 New Relic, Inc. All rights reserved

by "Liam Hurrell, New Relic" <emeamarketing@newrelic.com> - 05:36 - 24 Oct 2023 -

How companies are reimagining travel in the age of AI

On Point

A new era of travel Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

•

AI-directed air traffic. Researchers in the UK have created a digital twin of England’s airspace that may enable AI agents to work alongside humans to direct air traffic. By recommending energy-efficient routes, the virtual model, which uses data from ten million flight paths, could lower the environmental effects of flying. Using AI platforms to guide air traffic might also help to reduce delays at congested airports. The airline industry is grappling with a shortage of air traffic controllers, who complete three years of training to do the job. [FT]

•

Travel’s new era. Advances in AI are equipping the travel industry to reimagine how consumers experience travel. Most companies aim to provide exceptional service, but too often fall short of meeting expectations. Still, nearly a third of consumers intend to splurge on travel in the next three months, a 2023 McKinsey ConsumerWise survey finds. Closing the gap between the promise and reality of travel gives companies the opportunity to keep the desire to travel alive, says QuantumBlack, AI by McKinsey leader Ben Ellencweig and colleagues.

•

Smarter decisions. Travel companies are developing new tools for frontline workers to process complex inputs and help guide day-of decision making. For example, advanced simulation models such as digital twins allow companies to conduct rapid what-if analyses and provide real-time guidance. With a digital twin, when inclement weather occurs, crews can use live simulations to make more informed decisions about rerouting flights. To explore how digital technologies are reshaping travel, see our new report, The promise of travel in the age of AI.

— Edited by Belinda Yu, editor, Atlanta

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the On Point newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey On Point" <publishing@email.mckinsey.com> - 02:28 - 24 Oct 2023 -

The future of real estate in a hybrid world

Rethink the office New from McKinsey Global Institute

The future of real estate in a hybrid world

Rethink the office Prefer audio? Listen to the podcast, and explore past episodes of The McKinsey Podcast. Subscribe via Google Podcasts, iTunes, or Spotify.

Empty spaces and hybrid places: The pandemic’s lasting impact on real estate

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to our McKinsey Global Institute alert list.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey & Company" <publishing@email.mckinsey.com> - 12:57 - 24 Oct 2023 -

Track and Manage Waste Collecting Fleets with Advanced Waste Management Software - SmartWaste.

Track and Manage Waste Collecting Fleets with Advanced Waste Management Software - SmartWaste.

Grow sustainable waste collection businesses with SmartWaste Software.Plan optimum waste collection and disposal routes to maximize productivity.

Benefits

Grow sustainable waste collection businesses with SmartWaste Software.

Uffizio Technologies Pvt. Ltd., 4th Floor, Metropolis, Opp. S.T Workshop, Valsad, Gujarat, 396001, India

by "Sunny Thakur" <sunny.thakur@uffizio.com> - 08:00 - 23 Oct 2023 -

What’s going on that’s not generative AI? A leader’s guide to top trends

Trending now Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

Business leaders are generally optimistic about global economic conditions over the next six months, according to the latest McKinsey Global Survey on the economy. Sentiments vary by region, however: respondents in North America and India have a brighter outlook than those in Europe, where the effects of inflation raise concerns. For the sixth quarter in a row, geopolitical instability and political conflicts remain the most-cited risks to global growth, but private sector companies still believe their organizations will do well—two-thirds expect their profits to increase over the next six months, and most respondents expect customer demand to grow. Many companies plan to redesign the office space that they own or lease and to implement remote-work policies over the next few years, regardless of whether they expect their office space to shrink or expand.

That’s McKinsey’s Michael Chui, Mena Issler, Roger Roberts, and Lareina Yee in their report on the technology trends that matter most for companies in 2023. While generative AI may be the most hyped trend, “it stands as just one of many advances on the horizon that could drive sustainable, inclusive growth,” note the authors. For example, technologies such as cloud, edge, and quantum computing show great promise for value creation: edge will likely post double-digit growth in the next five years. According to the McKinsey authors, “Companies seeking longer-term growth should focus on a portfolio-oriented investment across the tech trends most important to their business.”

The growing middle-class segments of the population will likely have a major influence on business and society, says Brookings Institution economist Homi Kharas in an episode of McKinsey’s Forward Thinking podcast. “They shape our world, clearly, by politics,” he says. “But not just by politics. They’re shaping our world by their influence on the business sector. The middle class, increasingly, for example, is looking to push corporates to be more sustainable.” With their expansion fueled by technology, democratization, and globalization, the middle classes now total about four billion people—roughly half of the world’s population. The influence of these groups extends to “all parts of our lives,” says Kharas. “Every time you hear of something going viral, for example, what it really means is that the middle class has seized on this as an issue and is trying to elevate it.”

In the sci-fi TV series For All Mankind, which presents an alternative history of the 1960s space race, the superpowers set up bases on the moon and routinely fly lunar missions. That scenario may not be as far-fetched as it seems. Set to surge 41 percent over the next five years, the $469 billion space economy—broadly defined as activities in orbit or on other planets that benefit humans—is already transforming life on Earth, reports McKinsey senior partner Ryan Brukardt. For example, satellite technology powers our communications and helps monitor climate change, agriculture, and national security. But the biggest boost for organizations could come from functions that take place entirely in space, such as in-orbit R&D and manufacturing. Such breakthroughs may fuel the next industrial revolution—and help your business lift off.

Lead by spotting trends.

— Edited by Rama Ramaswami, senior editor, New York

Share these insights

Did you enjoy this newsletter? Forward it to colleagues and friends so they can subscribe too. Was this issue forwarded to you? Sign up for it and sample our 40+ other free email subscriptions here.

This email contains information about McKinsey’s research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the Leading Off newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Leading Off" <publishing@email.mckinsey.com> - 02:05 - 23 Oct 2023 -

Change is hard. But it can also give companies a competitive edge.

On Point

Managing change in an ever-changing world Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

•

The power of storytelling. As the world around them transforms continuously, organizations and their leaders have no choice but to transform in turn. Of course, large-scale organizational change can be destabilizing and anxiety-inducing for many employees. But storytelling is a powerful tool for building trust, even in uncertain times. Stories can make abstract concepts—such as the reasons for a company’s transformation and what that change might mean for people’s day-to-day work—feel personal and emotionally resonant. Stories about the changes under way can also influence people’s behaviors and actions so that they match the organization’s vision. [Quartz]

•

The will to succeed. After years of McKinsey research on transformations, some persistent truths remain: a comprehensive approach to change is best, and the value at stake is incredibly high—and easy to lose. What partner Rajesh Krishnan and coauthors tested this year is how, and by how much, four broad elements (will, skill, rigor, and scope) can affect a transformation’s outcomes: not only whether the effort achieved and sustained performance improvements, but also whether it enabled the company to outperform its competition.

— Edited by Daniella Seiler, executive editor, Washington, DC

Introducing Insights to Impact

Be among the first to subscribe to this free newsletter delivering a weekly roundup of analysis that’s influencing decision makers. Each Friday, we’ll offer insights across geographies, industries, and capabilities to help leaders identify new opportunities to spur innovation and growth, sustainably.

Click to subscribeThis email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the On Point newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey On Point" <publishing@email.mckinsey.com> - 01:23 - 23 Oct 2023 -

Meet the partners behind our most popular recent insights

Get to know them Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

New from McKinsey & Company

Our most popular insights over the past month touch on how organizations and individuals can overcome current challenges and prepare for the months and years ahead. Meet the McKinsey leaders behind these insights, which address employee disengagement and attrition, the effects of generative AI, how individuals can contribute to higher living standards and a greener world, effectively communicating the value of companies’ sustainability initiatives, and more.

To see more essential reading on topics that matter, visit McKinsey Themes.

— Edited by Joyce Yoo, editor, New York

And for insights on issues that matter most to the CEO and their colleagues in the C-suite, sign up for The CEO Shortlist, formerly The Shortlist. We’ve changed the focus (and name) of this newsletter to signal our commitment to helping CEOs, present and future, do the best job they can. Rest assured it will continue to deliver, twice monthly, a shortlist of articles and reports that are must-reads regardless of role—from C-level execs to the frontline.

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to our McKinsey Global Institute alert list.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey & Company" <publishing@email.mckinsey.com> - 06:39 - 22 Oct 2023

.png?width=1200&upscale=true&name=Group%20350452337%20(1).png)

.png?width=1040&upscale=true&name=Availble_in%20(1).png)