Archives

- By thread 5369

-

By date

- June 2021 10

- July 2021 6

- August 2021 20

- September 2021 21

- October 2021 48

- November 2021 40

- December 2021 23

- January 2022 46

- February 2022 80

- March 2022 109

- April 2022 100

- May 2022 97

- June 2022 105

- July 2022 82

- August 2022 95

- September 2022 103

- October 2022 117

- November 2022 115

- December 2022 102

- January 2023 88

- February 2023 90

- March 2023 116

- April 2023 97

- May 2023 159

- June 2023 145

- July 2023 120

- August 2023 90

- September 2023 102

- October 2023 106

- November 2023 100

- December 2023 74

- January 2024 75

- February 2024 75

- March 2024 78

- April 2024 74

- May 2024 108

- June 2024 98

- July 2024 116

- August 2024 134

- September 2024 130

- October 2024 141

- November 2024 171

- December 2024 115

- January 2025 216

- February 2025 140

- March 2025 220

- April 2025 233

- May 2025 239

- June 2025 303

- July 2025 182

-

โปรโมชั่น Smart Variable Speed Drive

Schneider Electric

Industries of the FutureSmart Variable Speed Drive - Industrial IoT Solutionพบกับ Smart Variable Speed Drive หรือ Invertor Solutions สุดล้ำที่สามารถสร้างสิ่งที่ดีที่สุดให้กับคุณด้วยสมาร์ทเทคโนโลยี เพื่อตอบรับการเข้าสู่ยุค Industrial iIOT

พบกับโปรโมชั่นสุดพิเศษจากชไนเดอร์!

Promotion => ATV340

คลิกด้านล่างเพื่อดูรายละเอียดโปรโมชั่นได้เลย!+ Lifecycle Services From energy and sustainability consulting to optimizing the life cycle of your assets, we have services to meet your business needs. Schneider Electric

46 Rungrojthanakul Building. 1st, 10th, 11th Floor, Ratchadapisek Road. Huaykwang

Bangkok - 10310, Thailand

Phone +662 617 5555© 2023 Schneider Electric. All Rights Reserved. Schneider Electric is a trademark and the property of Schneider Electric SE, its subsidiaries and affiliated companies. All other trademarks are the property of their respective owners.

by "Schneider Electric" <reply@se.com> - 11:01 - 29 Oct 2023 -

A new tool to visualize flows of trade around the world

Deepen your understanding

by "McKinsey & Company" <publishing@email.mckinsey.com> - 06:29 - 28 Oct 2023 -

The week in charts

The Week in Charts

Transitions in banking, medtech R&D spending, and more Share these insights

Did you enjoy this newsletter? Forward it to colleagues and friends so they can subscribe too. Was this issue forwarded to you? Sign up for it and sample our 40+ other free email subscriptions here.

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to The Week in Charts newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Week in Charts" <publishing@email.mckinsey.com> - 03:02 - 28 Oct 2023 -

EP83: Explaining 9 Types of API Testing

EP83: Explaining 9 Types of API Testing

This week’s system design interview: Python Vs C++ Vs Java! (Youtube video) Explaining 9 types of API testing API Vs SDK! System Design for Everyone! Explain the Top 6 Use Cases of Object Stores How to Build Your Engineering Metrics Program (Guide) (Sponsored) Forwarded this email? Subscribe here for moreThis week’s system design interview:

Python Vs C++ Vs Java! (Youtube video)

Explaining 9 types of API testing

API Vs SDK!

System Design for Everyone!

Explain the Top 6 Use Cases of Object Stores

How to Build Your Engineering Metrics Program (Guide) (Sponsored)

While sales and marketing have clear, well understood dashboards, engineering insight often feels just out of reach.

Structuring and correlating engineering data with a metrics program provides holistic visibility into engineering health, fosters delivery predictability, improves dev experience, and helps you communicate with the rest of the business in a common language.

Use this free guide to start your metrics program–inside you’ll learn to:

Identify leading and lagging indicators of engineering health

Benchmark metrics and define “good” for your team

Surface risk indicators and improvement opportunities

Build an improvement strategy with automation and goal setting

Python Vs C++ Vs Java!

Explaining 9 types of API testing

Smoke Testing

This is done after API development is complete. Simply validate if the APIs are working and nothing breaks.Functional Testing

This creates a test plan based on the functional requirements and compares the results with the expected results.Integration Testing

This test combines several API calls to perform end-to-end tests. The intra-service communications and data transmissions are tested.Regression Testing

This test ensures that bug fixes or new features shouldn’t break the existing behaviors of APIs.Load Testing

This tests applications’ performance by simulating different loads. Then we can calculate the capacity of the application.Stress Testing

We deliberately create high loads to the APIs and test if the APIs are able to function normally.Security Testing

This tests the APIs against all possible external threats.UI Testing

This tests the UI interactions with the APIs to make sure the data can be displayed properly.Fuzz Testing

This injects invalid or unexpected input data into the API and tries to crash the API. In this way, it identifies the API vulnerabilities.

Latest articles

If you’re not a subscriber, here’s what you missed this month.

The 6 Most Impactful Ways Redis is Used in Production Systems

The Tech Promotion Algorithm: A Structured Guide to Moving Up

To receive all the full articles and support ByteByteGo, consider subscribing:

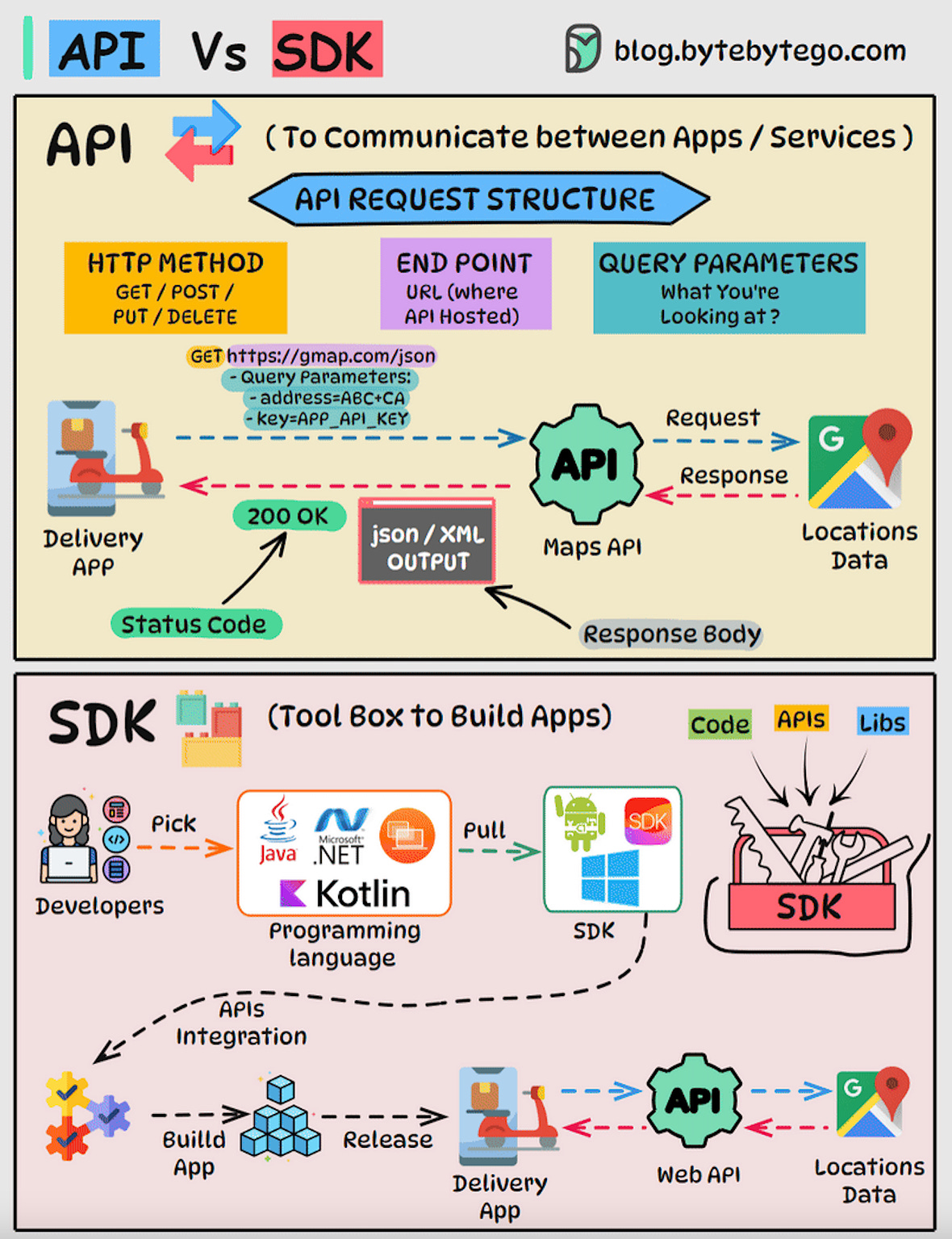

API Vs SDK!

API (Application Programming Interface) and SDK (Software Development Kit) are essential tools in the software development world, but they serve distinct purposes:

API:

An API is a set of rules and protocols that allows different software applications and services to communicate with each other.It defines how software components should interact.

Facilitates data exchange and functionality access between software components.

Typically consists of endpoints, requests, and responses.

SDK:

An SDK is a comprehensive package of tools, libraries, sample code, and documentation that assists developers in building applications for a particular platform, framework, or hardware.Offers higher-level abstractions, simplifying development for a specific platform.

Tailored to specific platforms or frameworks, ensuring compatibility and optimal performance on that platform.

Offer access to advanced features and capabilities specific to the platform, which might be otherwise challenging to implement from scratch.

The choice between APIs and SDKs depends on the development goals and requirements of the project.

Over to you:

Which do you find yourself gravitating towards – APIs or SDKs – Every implementation has a unique story to tell. What's yours?System Design for Everyone!

We've open-sourced the 'System Design 101' GitHub repo last week, which has just reached 35,000 stars.

Thanks to everyone who has starred, forked, or contributed to the repository. We got our 1st GitHub badge!

We are actively working on improving it and have merged 15 pull requests last week. Everyone is welcome to contribute.

What's included in the GitHub repository:100 byte-sized system concepts with visuals.

Real-world case studies.

Tips on how to prepare for system design interviews.

Topics included (and many many more):

SOAP vs. REST vs. GraphQL vs. RPC

HTTP 1.0 -> HTTP 1.1 -> HTTP 2.0 -> HTTP 3.0 (QUIC)

CI/CD Pipeline Explained in Simple Terms

8 Data Structures That Power Your Databases

Top caching strategies

What does a typical microservice architecture look like?

Start exploring the repository here.

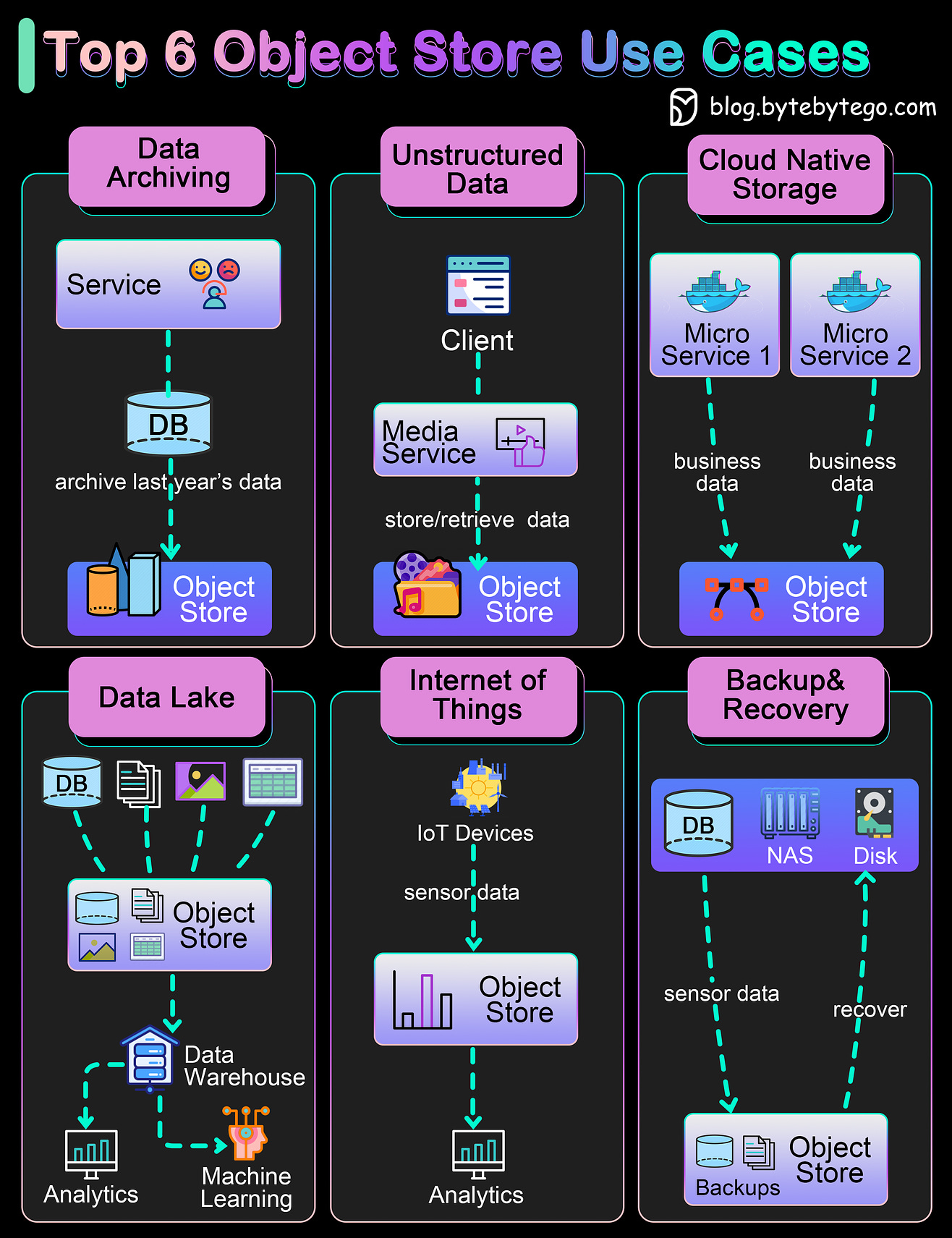

Explain the Top 6 Use Cases of Object Stores

What is an object store?

Object store uses objects to store data. Compared with file storage which uses a hierarchical structure to store files, or block storage which divides files into equal block sizes, object storage stores metadata together with the objects. Typical products include AWS S3, Google Cloud Storage, and Azure Blob Storage.

An object store provides flexibility in formats and scales easily.Case 1: Data Archiving

With the ever-growing amounts of business data, we cannot store all the data in core storage systems. We need to have layers of storage plan. An object store can be used to archive old data that exists for auditing or client statements. This is a cost-effective approach.Case 2: Unstructured Data Storage

We often need to deal with unstructured data or semi-structured data. In the past, they were usually stored as blobs in the relational database, which was quite inefficient. An object store is a good match for music, video files, and text documents. Companies like Spotify or Netflix uses object store to persist their media files.Case 3: Cloud Native Storage

For cloud-native applications, we need the data storage system to be flexible and scalable. Major public cloud providers have easy API access to their object store products and can be used for economical storage choices.Case 4: Data Lake

There are many types of data in a distributed system. An object store-backed data lake provides a good place for different business lines to dump their data for later analytics or machine learning. The efficient reads and writes of the object store facilitate more steps down the data processing pipeline, including ETL(Extract-Transform-Load) or constructing a data warehouse.Case 5: Internet of Things (IoT)

IoT sensors produce all kinds of data. An object store can store this type of time series and later run analytics or AI algorithms on them. Major public cloud providers provide pipelines to ingest raw IoT data into the object store.Case 6: Backup and Recovery

An object store can be used to store database or file system backups. Later, the backups can be loaded for fast recovery. This improves the system’s availability.

Over to you: What did you use object store for?

Latest articles

Here are the latest articles you may have missed:

To receive all the full articles and support ByteByteGo, consider subscribing:

Like

Comment

Restack

© 2023 ByteByteGo

548 Market Street PMB 72296, San Francisco, CA 94104

Unsubscribe

by "ByteByteGo" <bytebytego@substack.com> - 11:36 - 28 Oct 2023 -

From purpose to power: Defying the status quo

Readers & Leaders

Plus, 5 interviews on life and leadership lessons THIS MONTH'S PAGE-TURNERS ON BUSINESS AND BEYOND

You’ve just been blindsided by a business setback or a personal loss. The experience could render you crippled by caution, or it could help you reframe the future. As the interviews below demonstrate, life lessons can create opportunity for growth and innovation. At times, they can harness the potential that turns the biggest gambles into the greatest payoffs.

In this edition of Readers & Leaders, learn how perceived setbacks turned three authors into catalysts for change and transformed their approach to business and leadership. When met with the challenges of Ebola and energy deprivation in the poorest communities, Dr. Rajiv J. Shah, president of the Rockefeller Foundation, employed the “big bets” concept—using innovative solutions to tackle the world’s greatest problems. In a new Author Talks interview, Dr. Shah shares the importance of learning from others to enact change, why trusting your moral instincts is important, and why giving up control is essential to achieving scale and sustainability. In other featured interviews, Ron Shaich, founder and former CEO of Au Bon Pain and Panera Bread, explores how the loss of his parents helped him redefine a life well-lived and turn pain into purpose, and BBC analysis editor Ros Atkins discusses how a lost job opportunity triggered a journey into improving his communication skills.IT BEARS REPEATING

“I actually learned a playbook of how young people, in particular, can aspire to be changemakers. Anyone can be a changemaker if they adopt a big-bet mindset and are willing to think boldly—just as boldly as you would in the private sector. Think boldly about how you can actually make positive changes in this world.”

—Dr. Rajiv J. Shah, president, the Rockefeller Foundation, in an October edition of Author Talks.IN CASE YOU MISSED IT

Ron Shaich on why your life assessment shouldn’t happen “in the ninth inning, with two outs”: “Essentially, the process of a premortem, or defining today what’s going to matter tomorrow, is about figuring out, ‘Where do I want to land in the future? I know where I want to be in three years, in five, in seven. I could effectively build a plan to get there.’” Watch the full interview.

Ros Atkins offers a practical approach to effective explanation: “If you can spot the elements of those subjects that you’re not comfortable with, get the information to help you, and then do the preparation to make sure you can express that information clearly, you understand the subject, and you can then explain it.” Watch the full interview.TURN BACK THE PAGE

Looking to learn more about how life lessons could impact leadership in your organization? Revisit these 2023 Author Talks interviews.

1. IBM’s Ginni Rometty on leading with ‘good power’

2. Create your ‘reinvention road map’ in four easy steps

3. Embracing power and possibility in the aftermath of loss

4. How people-first leadership can make the sky the limit

5. The world’s longest study of adult development finds the key to happy livingBUSINESS BESTSELLERS TOP

8

BUSINESS OVERALL

BUSINESS HARDCOVER

DECISION MAKING

ECONOMICS

ORGANIZATIONAL BEHAVIOR

WORKPLACE CULTURE

DIVERSITY & INCLUSION

SUSTAINABILITY

BOOKMARK THIS

If you’d like to propose a book or author for #McKAuthorTalks, please email us at Author_Talks@McKinsey.com. Due to the high volume of requests, we will respond only to those being considered.

— Edited by Emily Adeyanju, an editor in McKinsey’s Charlotte office

Share these insights

Did you enjoy this newsletter? Forward it to colleagues and friends so they can subscribe too.

Was this issue forwarded to you? Sign up for it and sample our 40+ other free email subscriptions here.

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the Readers & Leaders newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Readers & Leaders" <publishing@email.mckinsey.com> - 11:27 - 28 Oct 2023 -

Hello, new API landscape!

Hello, new API landscape!

The 2024 stage is set for innovation and digital progress. How will you ensure your business thrives in this dynamic digital landscape?When we gazed into our Tyk crystal ball to look at upcoming trends for APIs (as we often do – we haven't just been named as Leaders in the Gartner® Magic Quadrant™ for no reason – more on that below), observability,

OpenTelemetry, and the importance of API monitoring stood out ten-fold.

These frameworks are reshaping how we monitor, trace, and optimise APIs by providing comprehensive insights into data flow across services and applications.

It's a huge focus for us, and we're backing that prediction up with a powerful new feature as part of Tyk 5.2... OpenTelemetry Tracing, launching any day now. In the meantime, check out our blogs and events below for all sorts of data-driven insights into your APIs!

P.S. Want to hear more from Tyk? Subscribe to our newsletter here

Tyk in the limelight

Tyk enters the Gartner LEADER club!

We got a bit bored of being one of Gartner's Magic Quadrant™ Visionaries, so we've made our way into the elite LEADER club! We're proud to be here. So, what's next? Universe dominator? Only Tyk will tell! Read our story and all the details here.

The resource hub

New blogs on the block

Maximising API performance

Allow us to share the wisdom of API-Topia on maximising API performance so your APIs – and your business – can flourish. Implementing each element below will bring you closer to the ultimate API performance you seek. Check it out.

3 trends for APIs in 2024

Looking to know what's crucial to the advancement of APIs next year? Three key themes crop up repeatedly: Observability, OpenTelemetry and the democratisation of APIs as they go mainstream. Read the blog.

SRE vs platform engineering

Site reliability engineering and platform engineering don’t need to be gearing up for some epic battle. Embracing both could lead to exciting outcomes for your API products and business. Let us explain… Find out more.

Coming to a location near you

Here are all the details on the latest and greatest events and speaker slots coming up in the Tyk universe:

API platform engineering fundamentals

Module 4: Building scalable API platforms – security, governance & open standards

API platform engineering fundamentals

Module 6: Measuring success and the future

of platform engineering

Want to be the first to hear about our events? Sign up here to stay in the loop.

We also have a PLETHORA of webinars on all sorts of API-related topics you can crack into and watch on-demand here, as well as the first 3 modules of that platform engineering fundamentals programme. Go on, you know you want to check them out.

As we look ahead to 2024, the world of APIs is poised for significant transformation, with observability, OpenTelemetry and exceptional API experiences at the fore. The stage is set for API Topia - where APIs come to live their best life. Come visit; no passport is required!

Tyk, 87a Worship Street, London, City of London EC2A 2BE, United Kingdom, +44 (0)20 3409 1911

by "Budhaditya Bhattacharya" <communities@tyk.io> - 11:04 - 27 Oct 2023 -

Gen AI and workers: What you should know

On Point

Industries that could be most affected Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

•

Huge gains. Organizational leaders and the public at large have rapidly embraced gen AI since ChatGPT’s launch in November 2022. Following the launch, multiple companies also announced the development and integration of different large language models. Gen AI could add up to $4.4 trillion annually to the global economy, according to recent McKinsey research. The banking, high-tech, and life sciences industries are among those that could see the biggest impact, McKinsey Digital’s global leader, Rodney Zemmel, and coauthors find.

•

Millions of job shifts. Gen AI could automate almost 10% of tasks in the US economy, say McKinsey senior partner Kweilin Ellingrud and partner Saurabh Sanghvi. Overall, roughly 12 million occupational shifts may need to happen by 2030 for workers to keep up. Ensuring the reskilling and upskilling of workers during this transition falls on individual companies. The silver lining? If companies are able to do so successfully, we could have more jobs in the future than we have today. Discover how gen AI is changing the game across industries in the latest edition of the McKinsey Quarterly Five Fifty.

— Edited by Kanika Punwani, editor, Southern California

Introducing Insights to Impact

Be among the first to subscribe to this free newsletter delivering a weekly roundup of analysis that’s influencing decision makers. Each Friday, we’ll offer insights across geographies, industries, and capabilities to help leaders identify new opportunities to spur innovation and growth, sustainably.

Click to subscribeThis email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the On Point newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey On Point" <publishing@email.mckinsey.com> - 01:41 - 27 Oct 2023 -

Beyond ‘quiet luxury,’ gen AI and the future of work, Tech for Execs, and more: The Daily Read weekender

Unwind and catch up on the week's big reads Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

TECH FOR EXECS

Our experts serve up a periodic look at the technology concepts leaders need to understand to help their organizations grow and thrive in the digital age.

What it is. Explainable AI (XAI) refers to the ability to understand how an AI-powered application arrived at a particular output. Thanks to complex algorithms in AI applications, this isn’t easy. But doing so is foundational to managing risks and ensuring that an AI application performs optimally.

Why we need it. While the neural networks running behind many AI apps are loosely modeled after the human brain, they often don’t process data in the ways that humans do. But if we can’t understand how AI arrived at a particular conclusion, how can skeptical users trust the results enough to take actions on them? XAI has business implications as well. It can help data scientists figure out why an app might be producing biased or inaccurate recommendations. Also, if regulators want proof that bias isn’t occurring—a mounting concern as more governments consider AI regulations—XAI makes it easier to provide that proof.

How to make AI interpretable. Data scientists are applying a number of “explainability” features—including local interpretable model-agnostic explanations (LIME) and Shapley additive explanations (SHAP)—to illuminate which data most influence an AI’s decisions. Still, only 25 percent of organizations enable XAI. Is your AI interpretable? Simple, easily interpretable algorithms often suffice, but when complexity is required, applying explainability techniques should become standard practice.QUOTE OF THE DAY

chart of the day

Ready to unwind?

—Edited by Joyce Yoo, editor, New York

Share these insights

Did you enjoy this newsletter? Forward it to colleagues and friends so they can subscribe too. Was this issue forwarded to you? Sign up for it and sample our 40+ other free email subscriptions here.

This email contains information about McKinsey’s research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to our McKinsey Quarterly Five Fifty alert list.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Daily Read" <publishing@email.mckinsey.com> - 12:18 - 27 Oct 2023 -

Learn the can’t-miss guiding principles for successful GenAI initiatives.

Learn the can’t-miss guiding principles for successful GenAI initiatives.

Learn requirements and architectural approaches to domain-specific LLMs for GenAI.

Navigate the Next Wave of GenAI:

Domain-Specific LLMsThursday, November 9, 2023

10:00am – 11:00am PSTRegister for the webinar

Stay at the Forefront of Innovation

Join our new GenAI webinar series to learn about the latest trends and best practices in generative AI from industry leaders and practitioners.

Navigate the Next Wave of GenAI: Domain-Specific LLMs

To gain competitive advantage, innovative companies are starting to embed large language models into proprietary workflows that support domain-specific use cases. Many of them choose open-source LLMs to reduce data and compute requirements as well as privacy risks. The results have the potential to accelerate and enrich all sorts of business functions, from customer service to document processing and more.

Join our discussion with Kevin Petrie, VP of Research at Eckerson Group, and Ro Shah, AI Product Director at Intel, to better understand how careful design, implementation, and governance will help you achieve success with the next of GenAI.

Topics include:

- The requirements and architectural approaches to domain-specific LLMs

- Common challenges, benefits, and use cases

- Must-know guiding principles for successful generative AI initiatives

Thursday, November 9, 2023 10:00am – 11:00am PST

Register for the webinar

Kevin Petrie

VP of Research at Eckerson Group

Ro Shah

AI Product Director at Intel's Data Center and AI Group

Sancha Huang Norris

Generative AI Marketing Lead at Intel's Data Center and AI Business Unit

If you forward this email, your contact information will appear in any auto-populated form connected to links in this email.

This was sent to info@learn.odoo.com because you are subscribed to Webinars. To view and manage your marketing-related email preferences with Intel, please click here.

© 2023 Intel Corporation

Intel Corporation, 2200 Mission College Blvd., M/S RNB4-145, Santa Clara, CA 95054 USA. www.intel.com

Privacy | Cookies | *Trademarks | Unsubscribe | Manage Preferences

by "Intel Corporation" <intel@plan.intel.com> - 04:02 - 26 Oct 2023 -

A Crash Course in Kubernetes

A Crash Course in Kubernetes

In today's world of complex, web-scale application backends made up of many microservices and components running across clusters of servers and containers, managing and coordinating all these pieces is incredibly challenging. That's where Kubernetes comes in. Kubernetes (also known as "k8s") is an open-source container orchestration platform that automates deployment, scaling, and management of containerized applications. Forwarded this email? Subscribe here for moreThis is a sneak peek of today’s paid newsletter for our premium subscribers. Get access to this issue and all future issues - by subscribing today.

Latest articles

If you’re not a subscriber, here’s what you missed this month.

The 6 Most Impactful Ways Redis is Used in Production Systems

The Tech Promotion Algorithm: A Structured Guide to Moving Up

To receive all the full articles and support ByteByteGo, consider subscribing:

In today's world of complex, web-scale application backends made up of many microservices and components running across clusters of servers and containers, managing and coordinating all these pieces is incredibly challenging.

That's where Kubernetes comes in. Kubernetes (also known as "k8s") is an open-source container orchestration platform that automates deployment, scaling, and management of containerized applications.

With Kubernetes, you don't have to worry about manually placing containers or restarting failed ones. You simply describe your desired application architecture and Kubernetes makes it happen and keeps it running.

In this two-part series, we'll dive deep into Kubernetes and cover:

Key concepts like pods, controllers, and services

The components that make up a Kubernetes cluster

When and why Kubernetes is useful for your applications

Tradeoffs to consider before adopting Kubernetes

We'll demystify Kubernetes and equip you with everything you need to determine if and when Kubernetes could be the right solution for your applications. You'll walk away with a clear understanding of what Kubernetes is, how it works, and how to put it into practice.

Whether you're a developer, ops engineer, or technology leader, you'll find invaluable insights in this deep dive into Kubernetes. Let's get started!

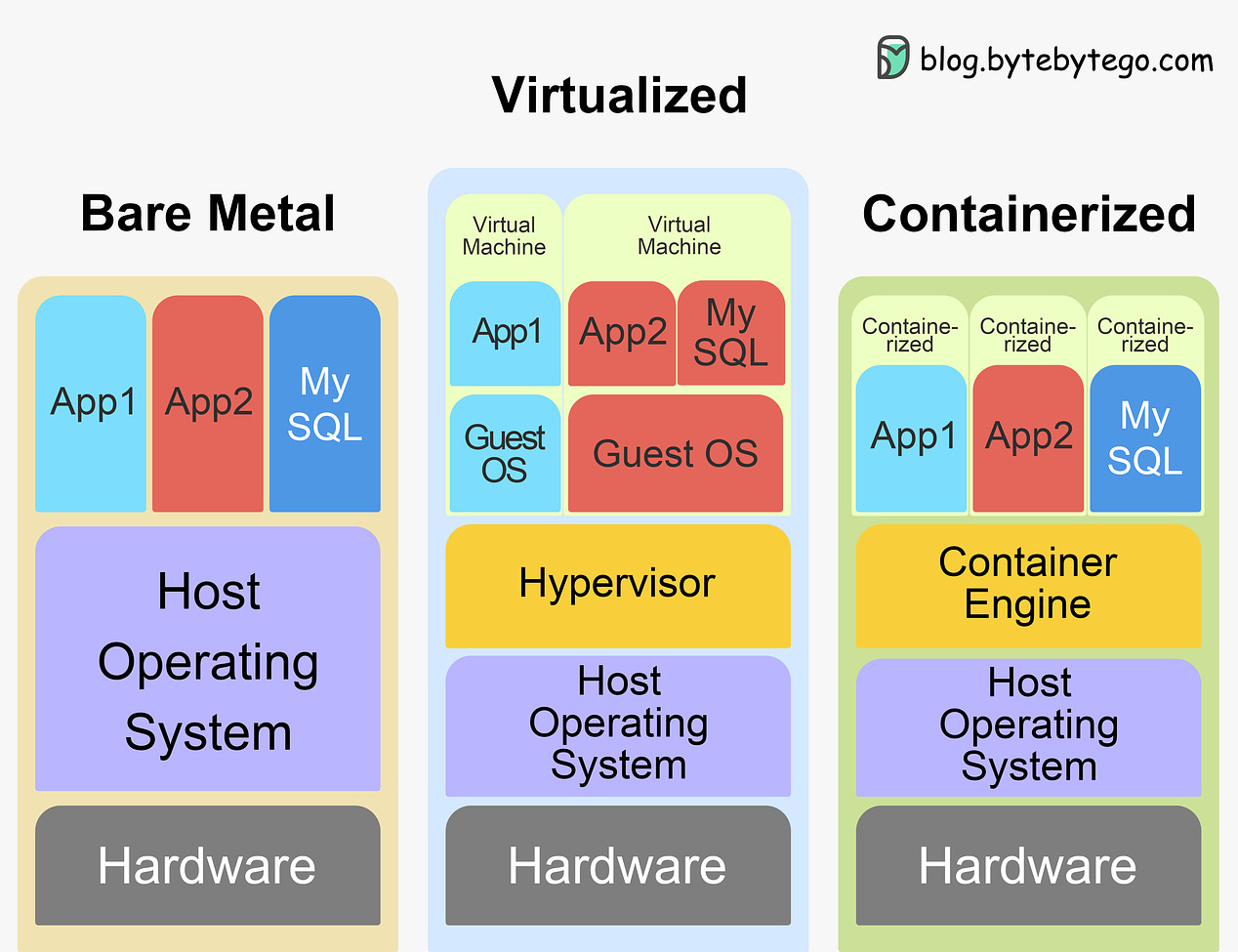

Brief History

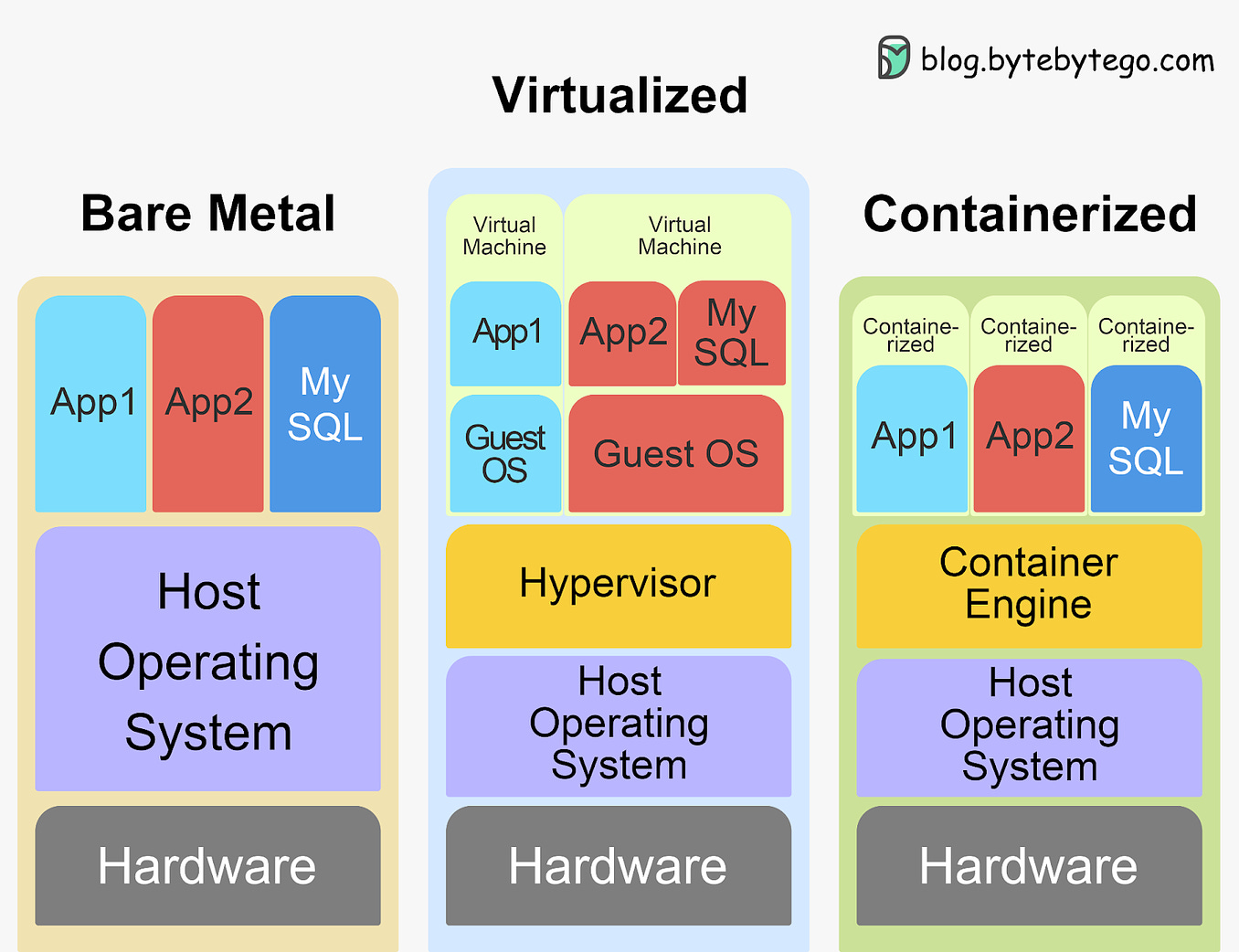

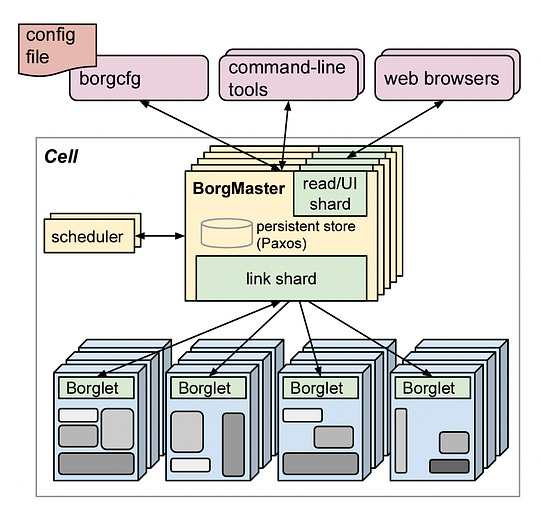

Kubernetes can be traced back to Google's internal container orchestration system, Borg, which managed the deployment of thousands of applications within Google. Containers are a method of packaging and isolating applications into standardized units that can be easily moved between environments. Unlike traditional virtual machines (VMs) which virtualize an entire operating system, containers only virtualize the application layer, making them more lightweight, portable and efficient.

In 2014, Google open-sourced a container orchestration system based on its learnings from Borg. This is Kubernetes. Kubernetes provides automated deployment, scaling and management of containerized applications. By leveraging containers rather than VMs, Kubernetes provides benefits like increased resource efficiency, faster deployment of applications, and portability across on-prem and cloud environments.

Why is it also called k8s? This is a somewhat nerdy way of abbreviating long words. The number 8 in k8s refers to the 8 letters between the first letter “k” and the last letter “s” in the word Kubernetes.

Kubernetes Architecture and Key Components

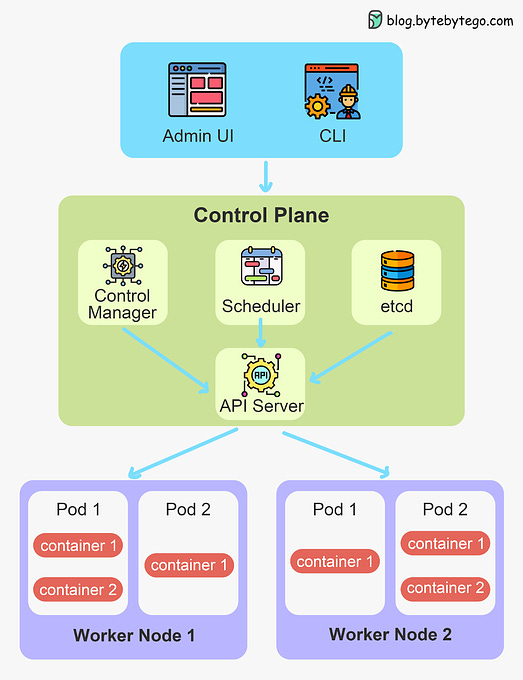

At its core, Kubernetes follows a client-server architecture. There are two core pieces in a Kubernetes cluster - control plane and worker nodes.

The control plane is responsible for managing the state of the cluster. In production environments, the control plane usually runs on multiple nodes that span across several data center zones.

In other words, the control plane manages worker nodes and the containers running on them.

The containerized applications run in a Pod. Pods are the smallest deployable units in Kubernetes. A pod hosts one or more containers and provides shared storage and networking for those containers. Pods are created and managed by the Kubernetes control plane. They are the basic building blocks of Kubernetes applications.

Let’s dive deeper into the main pieces.

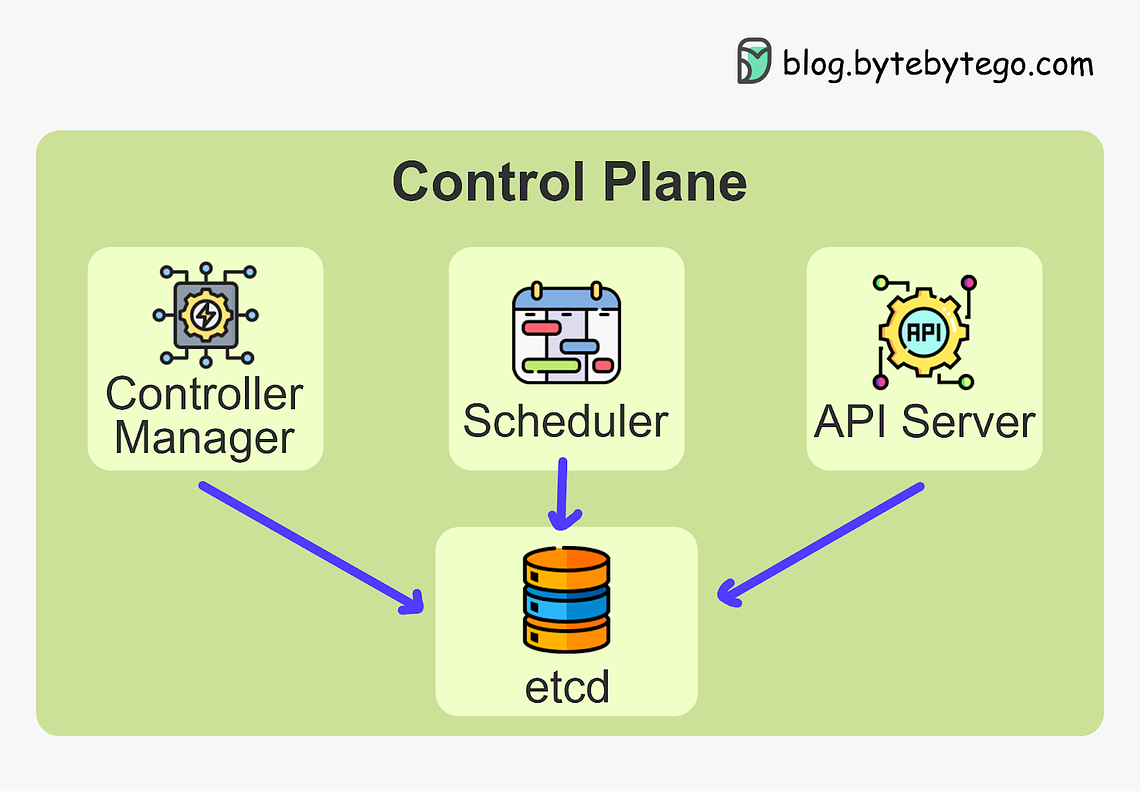

Kubernetes Control Plane

The control plane is the brain of Kubernetes. It consists of various components that, together, make global decisions about the cluster. The control plane components run on multiple servers across availability zones to provide high availability.

The key components are:

Kubernetes API Server

Etcd

Kubernetes Scheduler

Kubernetes Controller Manager

Keep reading with a 7-day free trial

Subscribe to

ByteByteGo Newsletterto keep reading this post and get 7 days of free access to the full post archives.A subscription gets you:

An extra deep dive on Thursdays Full archive Many expense it with team's learning budget Like

Comment

Restack

© 2023 ByteByteGo

548 Market Street PMB 72296, San Francisco, CA 94104

Unsubscribe

by "ByteByteGo" <bytebytego@substack.com> - 11:38 - 26 Oct 2023 -

3 steps to platform engineering mastery

3 steps to platform engineering mastery

Equip yourself with the knowledge and strategies needed to master platform engineering and API architecture.The road to API-Topia: A platform engineer’s handbook

We're thrilled to present our latest expert guide, The road to API-Topia: A platform engineer’s essential handbook, created in collaboration with industry expert James Higginbotham.

If you're ready to:

- Enhance your team's productivity.

- Streamline development processes.

- Master the art of efficient platform engineering...

This is the ultimate back-pocket resource you need to thrive in a new era of software development. Your journey towards success begins now!

See you there!

TykTyk, 87a Worship Street, London, City of London EC2A 2BE, United Kingdom, +44 (0)20 3409 1911

by "Tyk" <communities@tyk.io> - 09:47 - 26 Oct 2023 -

[eBook] How to take infrastructure monitoring to the next level

New Relic

The paradox of infrastructure monitoring is that the more mission-critical it becomes, the more complex it becomes to monitor and manage.

The paradox of infrastructure monitoring is that the more mission-critical it becomes, the more complex it becomes to monitor and manage.

DevOps and SRE teams face a sprawling network of complex systems and changing environments. This increasingly complex software infrastructure is now more critical to business success than it’s ever been. A mixed bag of metrics from a disconnected set of tools isn’t sufficient in today’s environment.

With observability, you can proactively collect, visualize, and apply intelligence to all of your metrics, events, logs, and traces in order to gain a holistic understanding of your entire software system.

How do you get there? In our eBook, we’ll look at four ways that DevOps and SRE teams can achieve true observability.

Download Ebook Need help? Let's get in touch.

This email is sent from an account used for sending messages only. Please do not reply to this email to contact us—we will not get your response.

This email was sent to info@learn.odoo.com Update your email preferences.

For information about our privacy practices, see our Privacy Policy.

Need to contact New Relic? You can chat or call us at +44 20 3859 9190.

Strand Bridge House, 138-142 Strand, London WC2R 1HH

© 2023 New Relic, Inc. All rights reserved. New Relic logo are trademarks of New Relic, Inc

Global unsubscribe page.

by "New Relic" <emeamarketing@newrelic.com> - 05:36 - 26 Oct 2023 -

Measuring software developer productivity is indeed possible

On Point

Four key steps to get started Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

•

Speedier code. Developers are embracing generative AI (gen AI) tools, which may be applied throughout the stages of software development. Gen AI platforms can suggest applications, propose code, and produce written documentation. In a study of 95 programmers, the developers who used a gen-AI-based tool were able to complete a task significantly faster than the group that did not. This suggests that such technologies could improve software developers’ overall output and boost the performance of less experienced coders. [Brookings]

•

Measuring productivity. Many leaders think that it’s not possible to measure software developers’ productivity. But with most companies becoming, to an extent, software companies, executives must know that they are using talent effectively, McKinsey senior partner Chandra Gnanasambandam and coauthors say. Software development is complex, creative work that requires tracking multiple metrics. To help overcome these challenges, McKinsey developed a way to evaluate developer productivity that is easier to implement with surveys or existing data.

— Edited by Belinda Yu, editor, Atlanta

Introducing Insights to Impact

Be among the first to subscribe to this free newsletter delivering a weekly roundup of analysis that’s influencing decision makers. Each Friday, we’ll offer insights across geographies, industries, and capabilities to help leaders identify new opportunities to spur innovation and growth, sustainably.

Click to subscribeThis email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the On Point newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey On Point" <publishing@email.mckinsey.com> - 02:24 - 26 Oct 2023 -

Press the Easy Button - A Log Analytics Buyer's Guide

Sumo Logic

(Free Download) Get the guide today

Master your log analytics. Master your business opportunities.

As log data expands, log management and analytics solutions continue to evolve. Keeping up with industry offerings can be a challenge, so we've created the Log management and analytics buyer's guide to help you find the right fit among modern solution offerings.

Learn more about Sumo Logic and the infinite power of log analytics.Sumo Logic, Level 9, 64 York Street, Sydney, NSW 2000

© 2023 Sumo Logic, All rights reserved.Unsubscribe

by "Sumo Logic" <marketing-info@sumologic.com> - 09:00 - 25 Oct 2023 -

SmartWaste - Advanced Waste Management Software that is designed to collect and manage multiple types of Waste.

SmartWaste - Advanced Waste Management Software that is designed to collect and manage multiple types of Waste.

Grow sustainable waste collection businesses with SmartWaste Software.Plan optimum waste collection and disposal routes to maximize productivity.

Benefits

Grow sustainable waste collection businesses with SmartWaste Software.

Uffizio Technologies Pvt. Ltd., 4th Floor, Metropolis, Opp. S.T Workshop, Valsad, Gujarat, 396001, India

by "Sunny Thakur" <sunny.thakur@uffizio.com> - 08:00 - 25 Oct 2023 -

Run payroll beyond borders: Expanding Global Payroll

Run payroll beyond borders: Expanding Global Payroll

Run multi-country payroll in minutes, with confidenceEarlier this year, we began rolling out Global Payroll - giving employers the confidence to run multi-country payroll with our modern platform and expert support.

Today, we're excited to expand Global Payroll to support compliant payroll processing in economic centers across Asia-Pacific, EMEA, Latin America, and North America.

In-house worldwide payroll expertise

Use Remote to consolidate global payroll across the top countries for tech talent around the world.

Plus, we're continuing to expand support for more countries over the coming months, including Brazil, Hong Kong, Israel, and Japan.

Consolidating multi-country payroll is simple with Remote

Compliant payroll, expert support, transparent pricing

Unite payroll processing across multiple countries to pay domestic and international team members from one simple hub - for one simple fee.

-

Reduce costs by centralizing payroll management

-

Ensure local compliance for every country

-

Direct support from in-house local payroll experts

-

Accurate, on-time, compliant payroll to level-up your employee experience

-

Tax and labor authority reporting handled for you

Request a demo today to see how you can save time, effort, and money with Remote Global Payroll.

You've got questions?

We've got answers.

Save time with 24/7 access to Remote’s Help Center.

You received this email because you are subscribed to News & Offers from Remote Technology, Inc.

Update your email preferences to choose the types of emails you receive.

Unsubscribe from all future emailsRemote Technology, Inc.

Copyright © 2023 Remote Technology, Inc. All rights reserved.

18 Bartol St. #1163 San Francisco California

by "Remote" <hello@remote-comms.com> - 07:02 - 25 Oct 2023 -

-

Working parents are often in critical roles. How can companies better support them?

On Point

Research on working families’ experiences Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

•

‘Fix the structure.’ Seeing millions of women exit the workforce made Reshma Saujani, the founder of Girls Who Code and the founder and CEO of the Marshall Plan for Moms, realize that making it possible for women to be moms and to work requires a different approach. “We have to stop trying to fix the woman and instead fix the structure,” says Saujani. That means paid leave, affordable childcare, and flexibility, adds Saujani, who joined McKinsey Global Institute director Kweilin Ellingrud and partner Kunal Modi on an episode of McKinsey’s Future of America podcast.

— Edited by Belinda Yu, editor, Atlanta

Introducing Insights to Impact

Be among the first to subscribe to this free newsletter delivering a weekly roundup of analysis that’s influencing decision makers. Each Friday, we’ll offer insights across geographies, industries, and capabilities to help leaders identify new opportunities to spur innovation and growth, sustainably.

Click to subscribeThis email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the On Point newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey On Point" <publishing@email.mckinsey.com> - 02:47 - 25 Oct 2023 -

ล็อคอิน mySchneider Program วันนี้ รับเลย 1,000 พอยท์!!

Schneider Electric

ล็อคอิน mySchneider วันนี้รับพ้อยเลย!!ล็อคอิน mySchneider Program วันนี้ รับเลย 1,000 พอยท์!!ข่าวด่วน !!! สำหรับสมาชิก mySchneider Program ทุกท่าน ! วันนี้ชไนเดอร์ใจดี อยากแจก

เพียงแค่ทำตามขั้นตอน ดังนี้

ขั้นตอนที่1 ล็อคอินเข้าระบบ ด้วย username และ password ของท่าน

ขั้นตอนที่2 คลิกแถบด้านบน ที่เขียนว่า "โปรแกรม" หรือ "Program"

ขั้นตอนสุดท้าย กด "enroll" หรือลงทะเบียน ในกล่อง ที่เขียนว่า IT Solution Provider

เพียงเท่านี้ก็รอรับ แต้ม จาก myReward 1,000 แต้ม เพื่อนำไปแลกของสัมนาคุณสุดฮิปได้เลยทันที !!!+ Lifecycle Services From energy and sustainability consulting to optimizing the life cycle of your assets, we have services to meet your business needs. Schneider Electric

46 Rungrojthanakul Building. 1st, 10th, 11th Floor, Ratchadapisek Road. Huaykwang

Bangkok - 10310, Thailand

Phone +662 617 5555© 2023 Schneider Electric. All Rights Reserved. Schneider Electric is a trademark and the property of Schneider Electric SE, its subsidiaries and affiliated companies. All other trademarks are the property of their respective owners.

by "Schneider Electric" <reply@se.com> - 11:01 - 24 Oct 2023 -

How will generative AI affect your workforce?

Five Fifty

Get your briefing Historically, automation has affected workers with lower education and skill levels. Generative AI is flipping the script: more-educated workers will likely experience the greatest degree of impact, say McKinsey’s Michael Chui and coauthors.

Share these insights

Did you enjoy this newsletter? Forward it to colleagues and friends so they can subscribe too. Was this issue forwarded to you? Sign up for it and sample our 40+ other free email subscriptions here.

This email contains information about McKinsey’s research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to our McKinsey Quarterly Five Fifty alert list.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Quarterly Five Fifty" <publishing@email.mckinsey.com> - 04:03 - 24 Oct 2023 -

Join me on Thursday to learn how to maximise observability with New Relic Logs

Hi MD,

Liam, Manager of Customer Training at New Relic University, here.

Are you getting the most from your log data when it comes to troubleshooting and observability? Are they easy-to-use or access when you need them?

If you'd like to improve how you use and work with your logs, you can register to attend the free online workshop I'll be hosting on Thursday 26th October at 10am BST/ 11am CEST- Maximising Observability with New Relic Logs. This 90-minute workshop will walk you through the different ways to bring log data to New Relic, the fast and easy to use UI, as well as parsing, filtering, or dropping logs to match your needs. With hands-on labs in a sandbox environment, you’ll get to search log data with ease and speed, work with partitions and AI log patterns, troubleshoot errors in applications and trace data, create charts and dashboards to share with teams, and set up alert conditions for problems you want to prevent.

You can find the full agenda on the registration page here. While we recommend attending the hands-on workshop live, you can also register to receive the recording.

I hope to see you then,

Liam Hurrell,Manager, Customer Training

This email was sent to info@learn.odoo.com as a result of subscribing or providing consent to receive marketing communications from New Relic. You can tailor your email preferences at any time here.Privacy Policy © 2008-23 New Relic, Inc. All rights reserved

by "Liam Hurrell, New Relic" <emeamarketing@newrelic.com> - 05:36 - 24 Oct 2023

.png?width=1200&upscale=true&name=Group%20350452337%20(1).png)

.png?width=1040&upscale=true&name=Availble_in%20(1).png)