Archives

- By thread 5334

-

By date

- June 2021 10

- July 2021 6

- August 2021 20

- September 2021 21

- October 2021 48

- November 2021 40

- December 2021 23

- January 2022 46

- February 2022 80

- March 2022 109

- April 2022 100

- May 2022 97

- June 2022 105

- July 2022 82

- August 2022 95

- September 2022 103

- October 2022 117

- November 2022 115

- December 2022 102

- January 2023 88

- February 2023 90

- March 2023 116

- April 2023 97

- May 2023 159

- June 2023 145

- July 2023 120

- August 2023 90

- September 2023 102

- October 2023 106

- November 2023 100

- December 2023 74

- January 2024 75

- February 2024 75

- March 2024 78

- April 2024 74

- May 2024 108

- June 2024 98

- July 2024 116

- August 2024 134

- September 2024 130

- October 2024 141

- November 2024 171

- December 2024 115

- January 2025 216

- February 2025 140

- March 2025 220

- April 2025 233

- May 2025 239

- June 2025 303

- July 2025 146

-

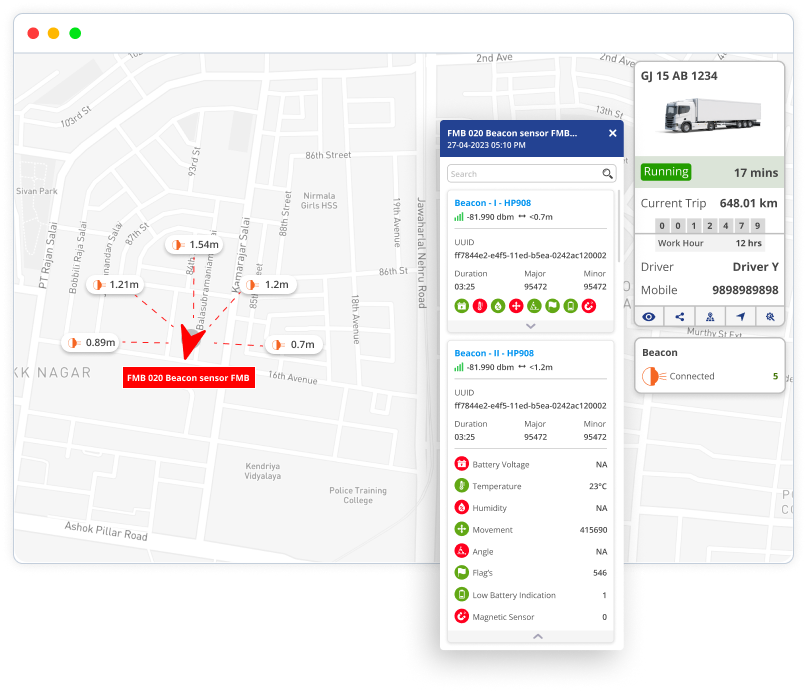

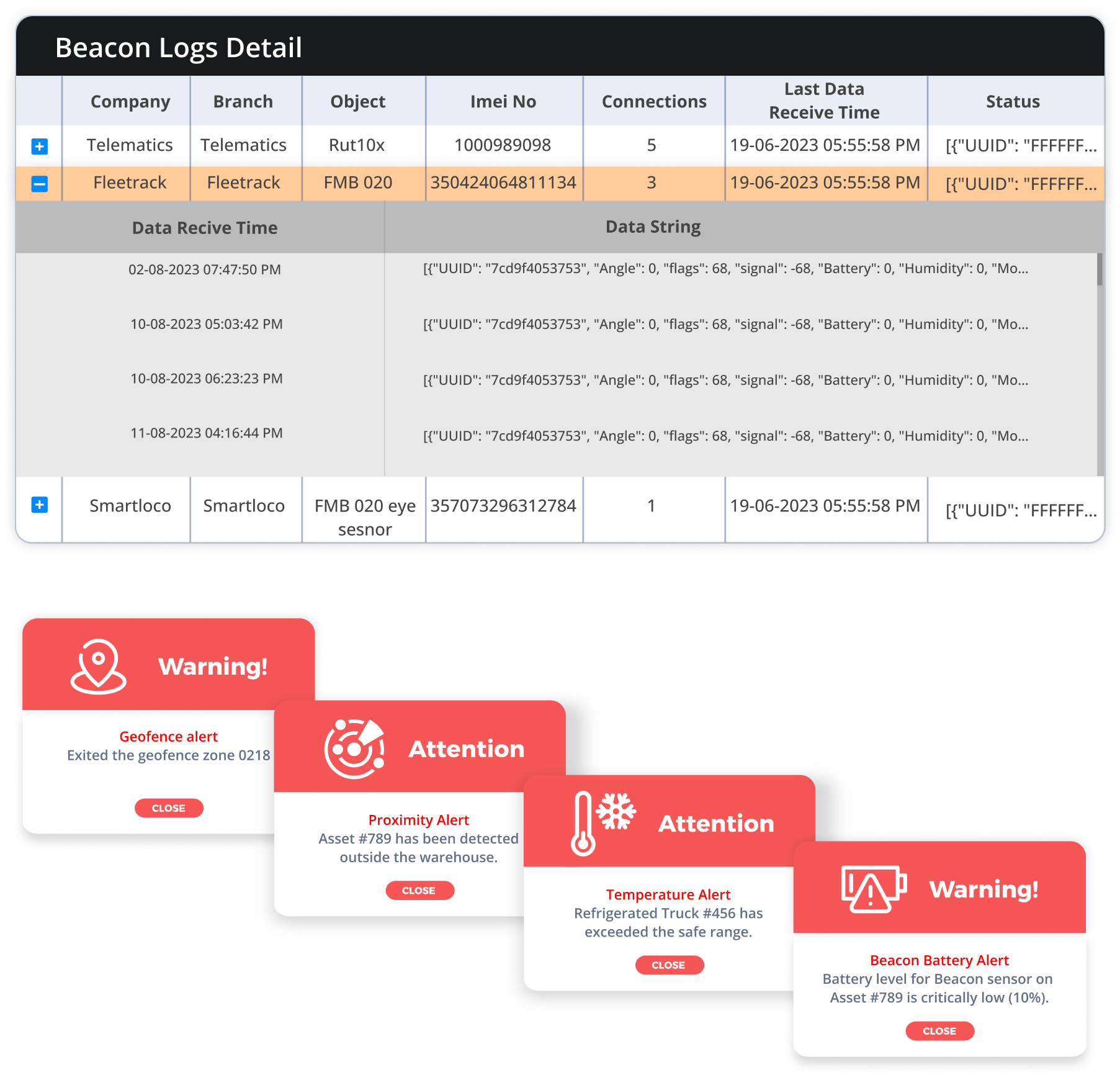

Beacon Advancements - Keep an Eye On Your Assets

Beacon Advancements - Keep an Eye On Your Assets

Unveil the future of data-driven management with beacon advancements. Elevate precision and efficiency for smarter operations.

Unveil the future of data-driven management with beacon advancements. Elevate precision and efficiency for smarter operations.

Find out what makes our software stand out from the crowd

Motion Detection

Leverage the software's motion data processing to enhance beacon capabilities.

Range Detection

Enhance fleet operations with precise proximity tracking using range detection beacons.

Alerts and Reports

Harness the power of beacon with real-time alerts, and customizable reports to enhance fleet operations, safety, and security.

Empower your clients with precision-powered beacon advancements

Uffizio Technologies Pvt. Ltd., 4th Floor, Metropolis, Opp. S.T Workshop, Valsad, Gujarat, 396001, India

by "Sunny Thakur" <sunny.thakur@uffizio.com> - 08:00 - 23 Aug 2023 -

How four economic scenarios could shape your business strategy

4 scenarios

by "McKinsey Daily Read" <publishing@email.mckinsey.com> - 06:30 - 23 Aug 2023 -

Are you making the most of middle managers?

On Point

How to treat middle managers Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

•

Burned out bosses. As organizations grapple with remote work, skilled talent shortages, and new trends in artificial intelligence, it’s no wonder that more than half of managers are feeling burned out, according to a Microsoft survey of 20,000 workers. Managers affect how engaged their teams are, so companies know it’s crucial to support them. Rather than mandating a return to the office, allowing managers to choose how often their team co-locates would enable them to better satisfy team members’ needs, an expert shares. [Inc.]

•

Essential roles. Although middle managers—leaders who sit somewhere between the front line and the C-suite—may be underappreciated, they’re essential to organizational health and performance, say McKinsey partners Emily Field and Bryan Hancock and senior partner emeritus Bill Schaninger, authors of the new book Power to the Middle: Why Managers Hold the Keys to the Future of Work. The best middle managers attract and develop high performers, bring a leader’s vision to reality, and can influence people’s day-to-day work.

•

Responsibility overload. Middle managers often face enormous demands on their time, especially when companies over rely on “player–coaches.” When bosses are responsible for leading teams and for contributing as individuals, sometimes there isn’t enough time in the day. Senior leaders are recognizing that by spending time with their managers problem solving and agreeing on a strategy, they can empower them to lead. Listen to the full episode of The McKinsey Podcast to understand how to bring out the best in middle managers.

— Edited by Belinda Yu, editor, Atlanta

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the On Point newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey On Point" <publishing@email.mckinsey.com> - 12:30 - 23 Aug 2023 -

Elevate your security skills with Observability and New Relic

New Relic

Security is a top concern for both individuals and companies. With the rising number of cyber-attacks and data breaches, developers need to have a strong grasp of security best practices. Application security directly affects the safety and privacy of user data.

To level up your security skill set, read our latest blog on how to use New Relic to discover, detect, and address issues in Juice Shop—an intentionally insecure web application from OWASP. Juice Shop, available on GitHub, is widely used for security training, demos and as a testing ground for security tools.

Learn how New Relic can help identify the OWASP top 10 vulnerabilities and other real-world security flaws.Read the latest Blog Need help? Let's get in touch.

This email is sent from an account used for sending messages only. Please do not reply to this email to contact us—we will not get your response.

This email was sent to info@learn.odoo.com Update your email preferences.

For information about our privacy practices, see our Privacy Policy.

Need to contact New Relic? You can chat or call us at +44 20 3859 9190.

Strand Bridge House, 138-142 Strand, London WC2R 1HH

© 2023 New Relic, Inc. All rights reserved. New Relic logo are trademarks of New Relic, Inc

Global unsubscribe page.

by "New Relic" <emeamarketing@newrelic.com> - 06:12 - 22 Aug 2023 -

It’s hard to predict a recession. Here’s how to prepare for one.

On Point

How resilient companies outperform Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

•

Economic jitters. Many Americans are worried that an economic slowdown is around the corner and that it might be as punishing as the 2007–09 financial crisis. Nearly seven out of ten respondents think a recession will hit in the next six months, and of those respondents, eight out of ten expect that the recession will be severe, according to a recent survey of 2,000 US adults. While experts don’t expect a bad recession, they acknowledge that rising prices and recent bank failures are shaking consumer confidence. [CNBC]

•

More volatility. While it’s hard to predict when a recession will happen, recessions do eventually occur. Economic downturns are all different, but we’ve learned some things about them, explains McKinsey’s Sven Smit, chair of insights and ecosystems and chair of the McKinsey Global Institute. Recessions are usually caused by imbalances in the market, the financial sector is always involved, and they typically start in one geographical area and spread to another. Unfortunately, higher volatility in the business environment has also become a new normal.

•

Prepare for uncertainty. Companies head into periods of uncertainty with varying degrees of readiness and health, and most fall into one of four camps. A lucky few are poised to thrive during a recession. These businesses experience relatively steady demand for high-margin products, easily attract and retain talent, and have simple supply chains. To see all four categories of preparedness, along with how any company can build systemic resilience, explore our McKinsey Explainer on recessions.

— Edited by Katherine Tam

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the On Point newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey On Point" <publishing@email.mckinsey.com> - 12:41 - 22 Aug 2023 -

How can flexibility services ensure gird reliability and resilience?

Schneider Electric

Our use case explains it all.Our use case explains it all.Modernization solutions for improved grid flexibility.By 2030, 70% of the renewables capacity is expected to be connected to distribution grids. However, the regulated and centralized control of distribution grids is not designed to accommodate this change.

So, how can you maintain overall system quality, reliability, and resilience while making your grids future-ready? Implementing flexibility solutions can help you address these limitations and mitigate constraint network management and investment deferral.

Our use case illustrates how to implement flexibility and presents country-specific flexibility models.+ Lifecycle Services From energy and sustainability consulting to optimizing the life cycle of your assets, we have services to meet your business needs. Schneider Electric

46 Rungrojthanakul Building. 1st, 10th, 11th Floor, Ratchadapisek Road. Huaykwang

Bangkok - 10310, Thailand

Phone +662 617 5555© 2023 Schneider Electric. All Rights Reserved. Schneider Electric is a trademark and the property of Schneider Electric SE, its subsidiaries and affiliated companies. All other trademarks are the property of their respective owners.

by "Schneider Electric" <reply@se.com> - 12:32 - 22 Aug 2023 -

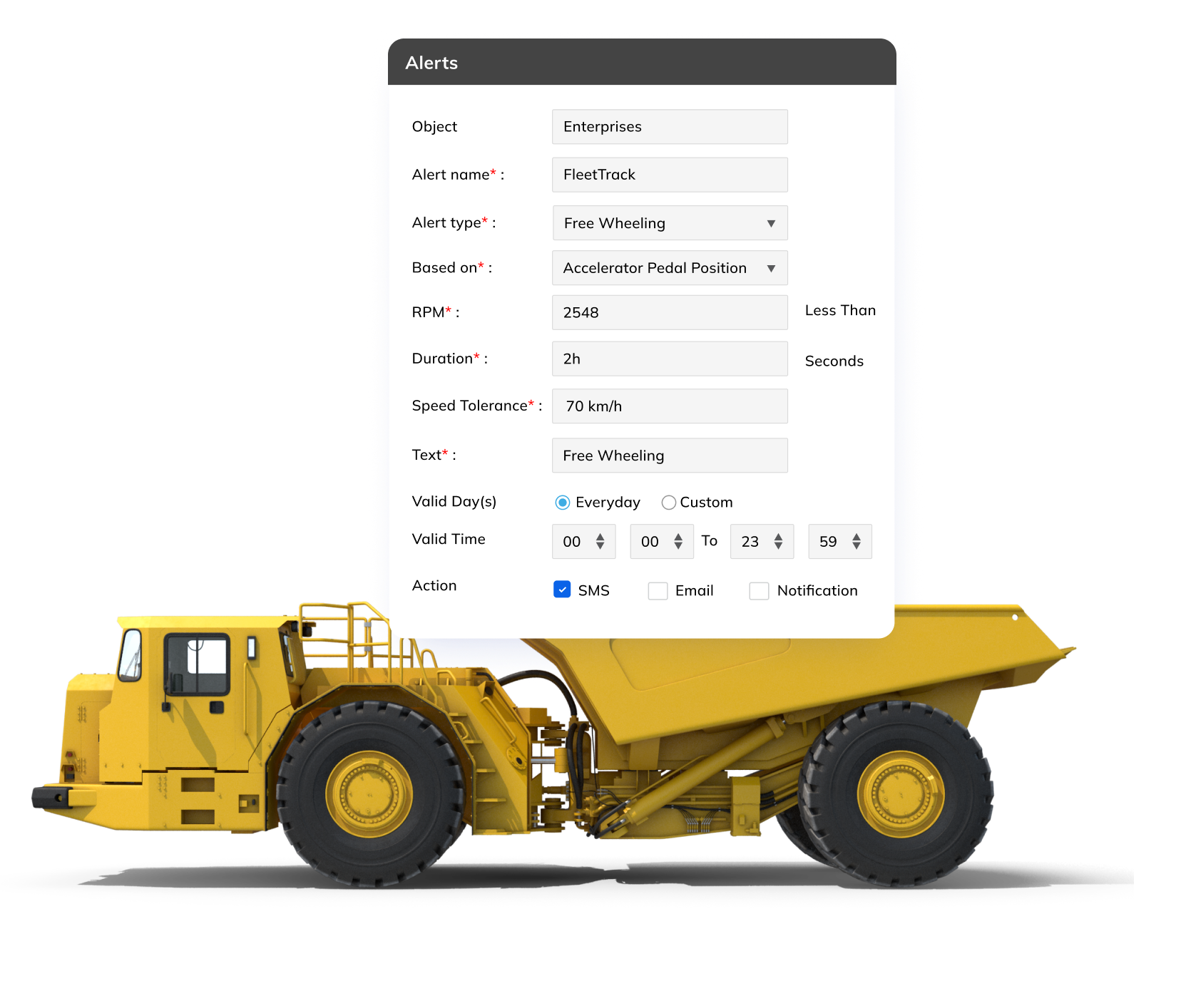

Elevate Fleet Efficiency: RPM Monitoring Use Cases that Drive Results

Elevate Fleet Efficiency: RPM Monitoring Use Cases that Drive Results

Ignite your business potential with RPM monitoring. Deliver unmatched benefits in fleet maintenance, efficiency, and cost-effectiveness.

Ignite your business potential with RPM monitoring. Deliver unmatched benefits in fleet maintenance, efficiency, and cost-effectiveness.

Use Cases

Construction

Engine work hour tracking for comprehensive equipment utilization analysis.

Mining

Customizable RPM thresholds with real-time alerts for deviations.

Trucking

Customized eco-friendly RPM thresholds with real-time alerts. Emission reduction analysis to optimize fuel efficiency.

Discuss your use-case to get your business growing

Uffizio Technologies Pvt. Ltd., 4th Floor, Metropolis, Opp. S.T Workshop, Valsad, Gujarat, 396001, India

by "Sunny Thakur" <sunny.thakur@uffizio.com> - 08:00 - 21 Aug 2023 -

It’s a stretch: A leader’s guide to flexible strategic planning

Sounds like a plan Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

More than 20 years ago, an executive told us that the annual strategic planning process at his organization resembled an exotic ritual put on for show. “No one is exactly sure why we do it, but there is an almost mystical hope that something good will come out of it.” By 2022, little had changed. “I have too often seen strategies that are actually a toxic mix of wishful thinking combined with a jumble of incoherent policies,” wrote the author of an article we published last year. To do what it’s supposed to do—advance an organization in the real world—strategy needs to be practical and dynamic, enabling leaders to remove obstacles to progress as they appear and solve problems on an ongoing basis. This flexible approach to strategic planning may involve broadening its traditional confines. This week, we explore some factors and trends to consider.

Growth, profit, and sustainability—those are the three factors to include in a flexible strategic-planning model. Companies that offer better shareholder returns than their peers outperform on growth and profitability while improving sustainability and environmental, social, and governance (ESG) practices. These “triple outperformers” are more than twice as likely as their peers to grow revenue by more than 10 percent a year. If you’re not sure whether your organization can pull off this triple play, consider these five suggestions from McKinsey senior partner Lucy Pérez and colleagues. The strategies of top performers are decidedly not old school: for example, one software provider has created a user-friendly interactive tool that publicly tracks its progress on key ESG metrics, and a logistics company has developed innovative mechanisms to solve its customers’ supply chain challenges.

That’s the number of facets in a chief strategist’s role, according to classic McKinsey research. These facets, in turn, can be grouped into five clusters, or archetypes, that embody a strategist’s signature strengths. For example, in the “visionary” archetype, the strategist functions as a trend forecaster, innovator, and business developer—tasks that were relatively uncommon a few years ago but are becoming essential aspects of the role today. For more strategic principles that have stood the test of time, take a look at the probability-based research led by McKinsey senior partners Chris Bradley and Sven Smit, in which they discuss “the tension between the real data of what makes good strategy and the games that are being played in the strategy room.”

That’s McKinsey global managing partner Bob Sternfels, senior partner Ryan Brukardt, and colleagues on why you shouldn’t ignore the space economy. Valued at nearly half a trillion dollars and growing at about 9 percent annually, space-related applications and technologies offer vast potential across most sectors: for example, satellites can detect weather patterns that may affect agriculture, energy generation, insurance, and shipping. “It’s no longer possible to say that space is too many degrees removed from your business,” say the McKinsey experts. “Create a new space business line, as some companies outside the aerospace industry have already done. Don’t be left on the ground.”

“What we know about volatility is that it’s a great time to be a strategist,” says McKinsey partner Emma Gibbs in an Inside the Strategy Room podcast. “You don’t need strategists when the world is smooth sailing.” An update of McKinsey research conducted ten years ago shows that the role of chief strategist has broadened considerably since then. “We’ve seen, in recent times, the rise of the ‘and’ strategist, which is, ‘I’m the chief strategist, and I also have another role,’” notes Gibbs. Ninety-one percent of respondents to our latest survey of strategy leaders say that besides strategy, they own other functions such as sustainability, digital, and data and analytics. “It’s not necessarily a bad thing that this is happening,” suggests Gibbs. “In many cases, I think it’s reflective of the breadth of topics that a strategist needs to consider as they think about the strategy.”

Listening to music can boost creativity—and what better creative juice than a McKinsey-curated playlist to inspire your best strategies? Check out our handpicked list of songs, which we’ve paired with McKinsey articles and interviews, along with books on business, social, environmental, and spiritual themes. These reading-and-song combos may be just what you need to spark the disruptive and innovative thinking that can advance your organization’s business.

Lead strategically.

— Edited by Rama Ramaswami, senior editor, New York

Share these insights

Did you enjoy this newsletter? Forward it to colleagues and friends so they can subscribe too. Was this issue forwarded to you? Sign up for it and sample our 40+ other free email subscriptions here.

This email contains information about McKinsey’s research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the Leading Off newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Leading Off" <publishing@email.mckinsey.com> - 01:06 - 21 Aug 2023 -

How could generative AI and automation technologies transform work in America?

On Point

In-demand careers and skills Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

•

CEOs’ plans for AI. Some experts speculate that generative AI poses an existential threat to workers. In banking, insurance, and IT, US companies are already using AI to provide investment tips, detect fraud, and draft letters welcoming new colleagues. What the technologies can’t do is replace human ingenuity, judgment, and empathy, according to top US CEOs. For the moment, leaders should consider AI to be a tool to augment, rather than replace, human capabilities, says the CEO of a global financial-services firm. [Fortune]

•

Changing roles. The US labor market is evolving fast. Many employees are working flexibly from the home and office, and employers are speeding up adoption of automation technologies. Generative AI is extending the possibilities for automation to a much wider set of careers. Amid this disruption, workers changed jobs at a remarkable pace. From 2019 to 2022, some 8.6 million occupational shifts occurred in the US. Twelve million more job shifts may be needed by 2030, McKinsey Global Institute director Kweilin Ellingrud and coauthors explain.

•

Accelerating automation. With generative AI in the mix, automation is about to affect a wider set of work activities involving expertise, interaction with people, and creativity. Automation could take over tasks that account for about 30% of hours worked in the US economy by 2030. The employment mix could change significantly through 2030, with more healthcare, STEM, and managerial positions and fewer customer service, office support, and food services jobs. Consider how employers can fill the jobs of the future.

— Edited by Belinda Yu, editor, Atlanta

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to the On Point newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey On Point" <publishing@email.mckinsey.com> - 12:55 - 21 Aug 2023 -

The CEO life cycle

From starting strong to sending it forward Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

New from McKinsey & Company

Every chapter of the CEO journey comes with a unique set of challenges—and opportunities. Whether you’re a senior executive who aspires to the top job or you’re a celebrated CEO who’s preparing to pass the baton to a successor, check out this series of McKinsey Quarterly articles from senior partners Carolyn Dewar, Scott Keller, Vikram Malhotra, and Kurt Strovink for high-impact leadership advice. Then dive into lessons from the world’s best CEOs, and bookmark The McKinsey guide to excelling as a CEO for the latest insights on topics that should be at the top of your agenda.

ACHIEVING CEO EXCELLENCE

Bookmark The McKinsey guide to excelling as a CEO for expert insights and advice on topics that should be at the top of your CEO agenda, including gen AI, digital transformations, the changing talent landscape, growth and resilience, the net-zero transition, DEI, and more.

— Edited by Eleni Kostopoulos, managing editor, New York

This email contains information about McKinsey’s research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to our McKinsey Quarterly alert list.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey & Company" <publishing@email.mckinsey.com> - 06:12 - 20 Aug 2023 -

The week in charts

The Week in Charts

Ukrainians relocate to neighboring countries, inflation concerns, and more Share these insights

Did you enjoy this newsletter? Forward it to colleagues and friends so they can subscribe too. Was this issue forwarded to you? Sign up for it and sample our 40+ other free email subscriptions here.

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to The Week in Charts newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Week in Charts" <publishing@email.mckinsey.com> - 03:56 - 19 Aug 2023 -

EP73: Cheat sheet of different databases in cloud services

EP73: Cheat sheet of different databases in cloud services

This week’s system design refresher: Top 6 Load Balancing Algorithms Every Developer Should Know (Youtube video) Cheat sheet of different databases in cloud services HTTPS, SSL Handshake, and Data Encryption Explained to Kids How does Chrome work? The 2023 State of the API Report is here! (Sponsored) View in browser This week’s system design refresher:

Top 6 Load Balancing Algorithms Every Developer Should Know (Youtube video)

Cheat sheet of different databases in cloud services

HTTPS, SSL Handshake, and Data Encryption Explained to Kids

How does Chrome work?

The 2023 State of the API Report is here! (Sponsored)

For the fifth year, the State of the API is the world's largest and most comprehensive survey and report on APIs. More than 40,000 developers and API professionals have shared their thoughts on development priorities, their API tools, and where they see APIs going.

Top 6 Load Balancing Algorithms Every Developer Should Know

Static Algorithms

1. Round robin

The client requests are sent to different service instances in sequential order. The services are usually required to be stateless.

2. Sticky round-robin

This is an improvement of the round-robin algorithm. If Alice’s first request goes to service A, the following requests go to service A as well.

3. Weighted round-robin

The admin can specify the weight for each service. The ones with a higher weight handle more requests than others.

4. Hash

This algorithm applies a hash function on the incoming requests’ IP or URL. The requests are routed to relevant instances based on the hash function result.Dynamic Algorithms

5. Least connections

A new request is sent to the service instance with the least concurrent connections.

6. Least response time

A new request is sent to the service instance with the fastest response time.

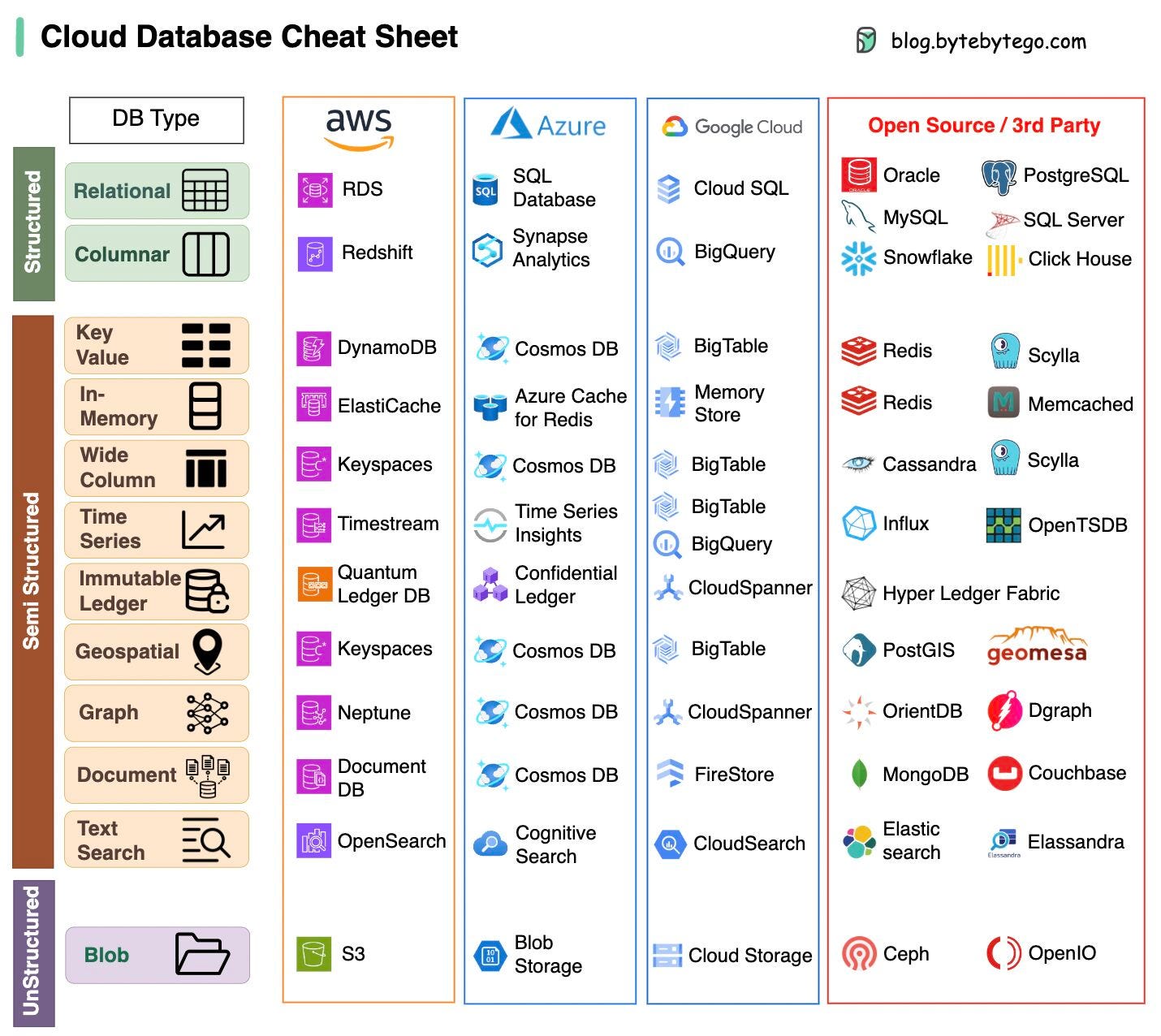

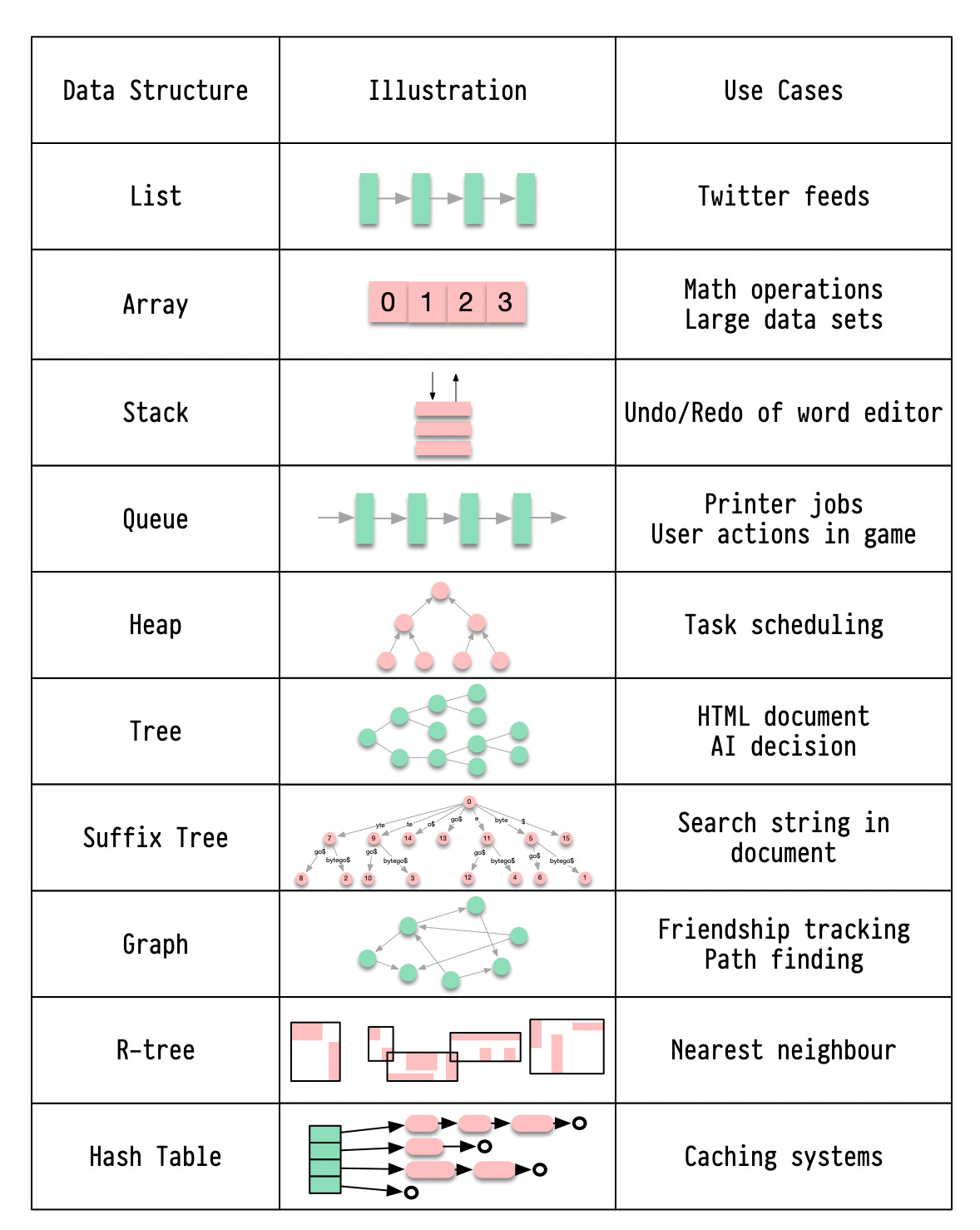

A nice cheat sheet of different databases in cloud services

Choosing the right database for your project is a complex task. The multitude of database options, each suited to distinct use cases, can quickly lead to decision fatigue.

We hope this cheat sheet provides high level direction to pinpoint the right service that aligns with your project's needs and avoid potential pitfalls.

Note: Google has limited documentation for their database use cases. Even though we did our best to look at what was available and arrived at the best option, some of the entries may be not accurate.

Over to you: Which database have you used in the past, and for what use cases?Latest articles

If you’re not a subscriber, here’s what you missed this month.

"I Was Under Leveled!" — Avoiding the Tragedy of Making Only $500k a Year

Network Protocols behind Server Push, Online Gaming, and Emails

To receive all the full articles and support ByteByteGo, consider subscribing:

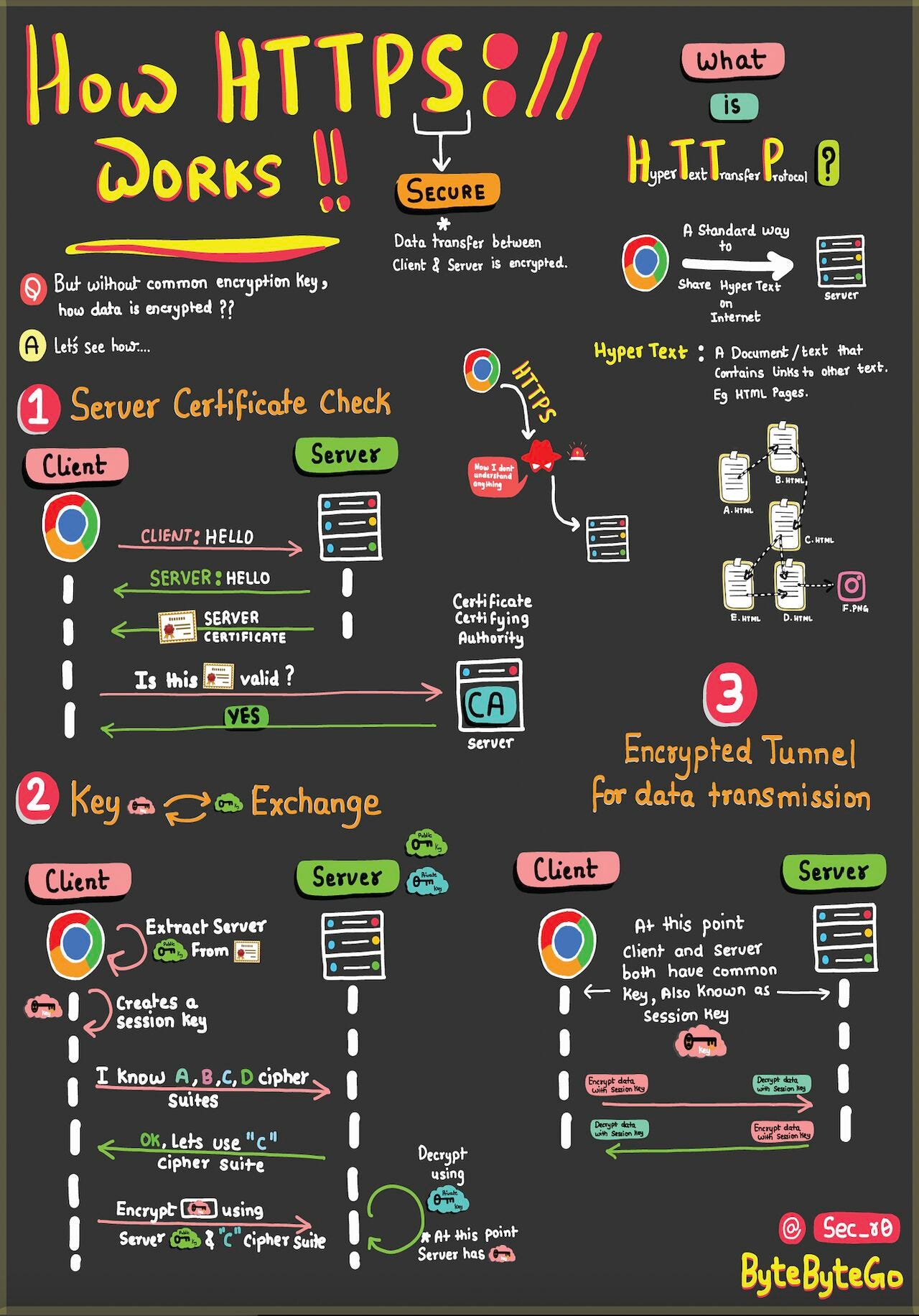

HTTPS, SSL Handshake, and Data Encryption Explained to Kids

HTTPS: Safeguards your data from eavesdroppers and breaches. Understand how encryption and digital certificates create an impregnable shield.

SSL Handshake: Behind the Scenes — Witness the cryptographic protocols that establish a secure connection. Experience the intricate exchange of keys and negotiation.

Secure Data Transmission: Navigating the Tunnel — Journey through the encrypted tunnel forged by HTTPS. Learn how your information travels while shielded from cyber threats.

HTML's Role: Peek into HTML's role in structuring the web. Uncover how hyperlinks and content come together seamlessly. And why is it called HYPER TEXT.

Over to you: In this ever-evolving digital landscape, what emerging technologies do you foresee shaping the future of cybersecurity or the web?How does Chrome work?

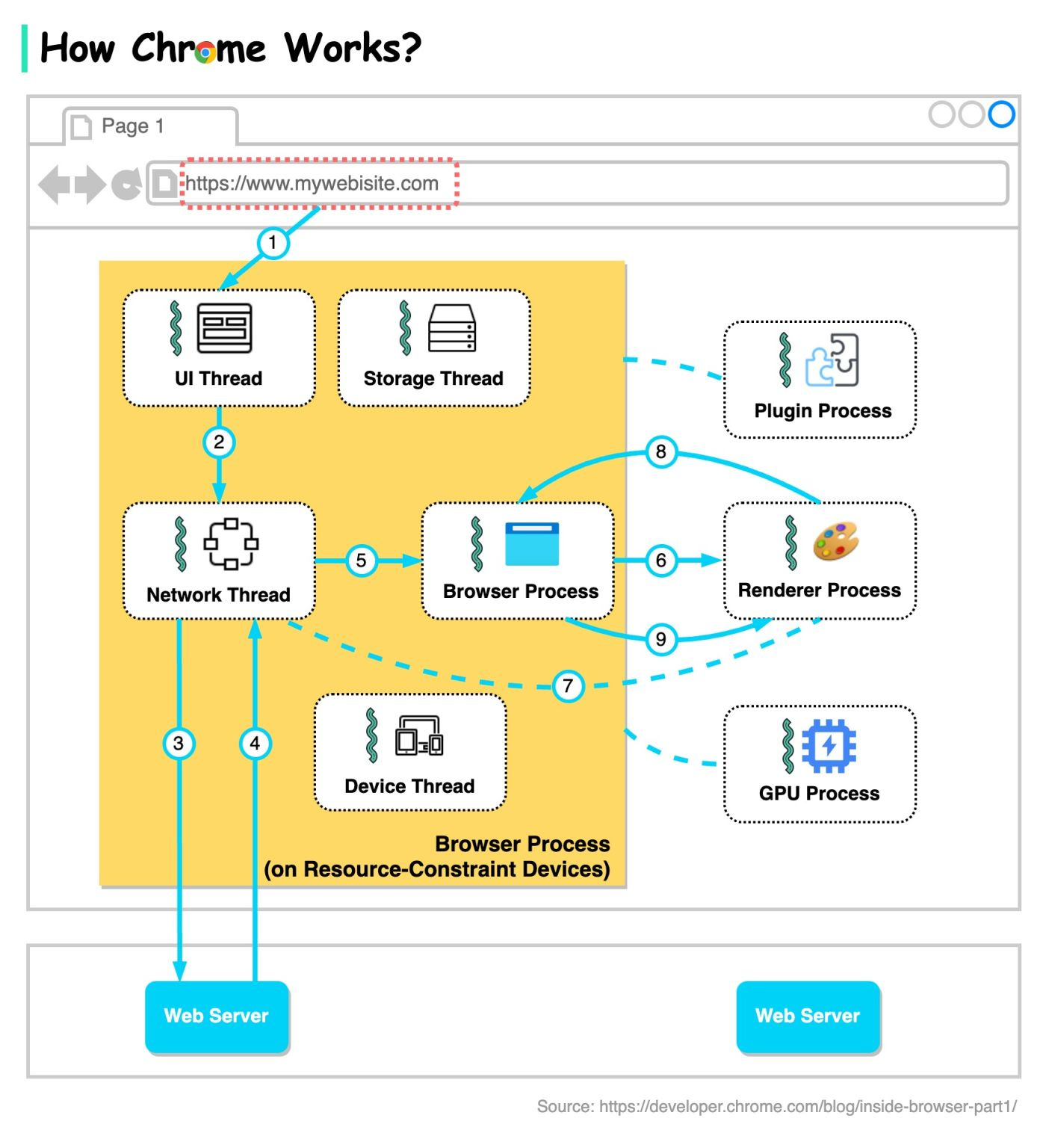

The diagram below shows the architecture of a modern browser. It is based on our understanding of “Inside look at modern web browser” published by the chrome team.

There are in general 4 processes: browser process, renderer process, GPU process, and plugin process.

Browser process controls address bar, bookmarks, back and forward buttons, etc.

Renderer process controls anything inside of the tab where a website is displayed.

GPU process handles GPU tasks.

Plugin process controls the plugins used by the websites.

The browser process coordinates with other processes.

When Chrome runs on powerful hardware, it may split each service in the browser process into different threads, as the diagram below shows. This is called Servicification.

Now let’s go through the steps when we enter a URL in Chrome.

Step 1: The user enters a URL into the browser. This is handled by the UI thread.

Step 2: When the user hits enter, the UI thread initiates a network call to get the site content.

Steps 3-4: The network thread goes through appropriate network protocols and retrieves the content.

Step 5: When the network thread receives responses, it looks at the first few bytes of the stream. If it is an HTML file, it is passed to the renderer process by the browser process.

Steps 6-9: An IPC is sent from the browser process to the renderer process to commit the navigation. A data pipe is established between the network thread and the renderer process so that the renderer can receive data. Once the browser process hears confirmation that the commit has happened in the renderer process, the navigation is complete and the document loading phase begins.Over to you: Why does Chrome assign each tab a renderer process?

Latest articles

Here are the latest articles you may have missed:

To receive all the full articles and support ByteByteGo, consider subscribing:

Like

Comment

Restack

© 2023 ByteByteGo

548 Market Street PMB 72296, San Francisco, CA 94104

Unsubscribe

by "ByteByteGo" <bytebytego@substack.com> - 11:35 - 19 Aug 2023 -

The CFO’s guide to digitizing the finance function

Capture the AI potential Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

The CFO’s guide to digitizing the finance function

A company’s digital core is increasingly becoming the purview of the CFO, who must work in lockstep with the CEO to help lead the kind of digital- and AI-transformation efforts that many organizations today are pursuing. A flurry of enticing trending technologies—from Web3 to cloud computing to generative AI—carry with them great promise for improving process efficiencies and unlocking significant value, but for many of today’s finance leaders, achieving these results remains elusive.

Half a decade ago, as finance functions increasingly explored the promising benefits of automation and artificial intelligence, Ishaan Seth and the coauthors of this McKinsey classic article challenged CFOs to consider three key actions as they moved to a digital finance operating model: understand which activities should be automated to deliver the most value, rethink processes around the technology to unleash its full potential, and manage the disruption that will inevitably result from these changes.

Today’s finance leaders will help define how companies use tomorrow’s leading technologies. To help ensure success for you and your people, read our 2018 classic “Bots, algorithms, and the future of the finance function.”The CFO of the future

In the face of volatility, CFOs—and their organizations—adapt

Share these insights

Did you enjoy this newsletter? Forward it to colleagues and friends so they can subscribe too. Was this issue forwarded to you? Sign up for it and sample our 40+ other free email subscriptions here.

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to our McKinsey Classics newsletter.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Classics" <publishing@email.mckinsey.com> - 11:21 - 19 Aug 2023 -

Electrification for two-wheelers, the recipe for Asia’s success story, building a closer relationship to the planet, and more: The Daily Read weekender

This week's highlights Brought to you by Liz Hilton Segel, chief client officer and managing partner, global industry practices, & Homayoun Hatami, managing partner, global client capabilities

QUOTE OF THE DAY

chart of the day

Ready to unwind?

—Edited by Joyce Yoo, editor, New York

Share these insights

Did you enjoy this newsletter? Forward it to colleagues and friends so they can subscribe too. Was this issue forwarded to you? Sign up for it and sample our 40+ other free email subscriptions here.

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to our McKinsey Global Institute alert list.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Daily Read" <publishing@email.mckinsey.com> - 06:25 - 18 Aug 2023 -

How to Choose a Message Queue? Kafka vs. RabbitMQ

How to Choose a Message Queue? Kafka vs. RabbitMQ

In the last issue, we discussed the benefits of using a message queue. Then we went through the history of message queue products. It seems that nowadays Kafka is the go-to product when we need to use a message queue in a project. However, it's not always the best choice when we consider specific requirements. Open in app or online This is a sneak peek of today’s paid newsletter for our premium subscribers. Get access to this issue and all future issues - by subscribing today.

Latest articles

If you’re not a subscriber, here’s what you missed this month.

"I Was Under Leveled!" — Avoiding the Tragedy of Making Only $500k a Year

Network Protocols behind Server Push, Online Gaming, and Emails

To receive all the full articles and support ByteByteGo, consider subscribing:

In the last issue, we discussed the benefits of using a message queue. Then we went through the history of message queue products. It seems that nowadays Kafka is the go-to product when we need to use a message queue in a project. However, it's not always the best choice when we consider specific requirements.

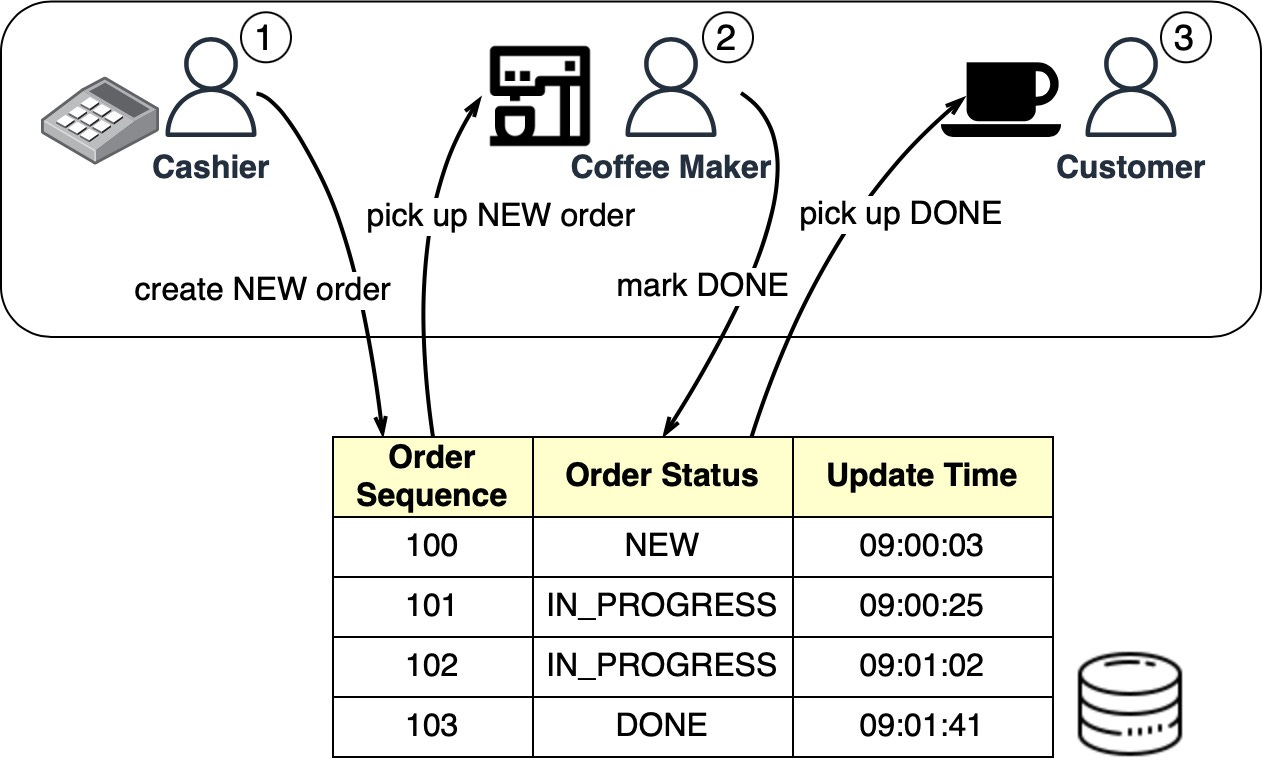

Database-Backed Queue

Let’s use our Starbucks example again. The two most important requirements are:

Asynchronous processing so the cashier can take the next order without waiting.

Persistence so customers’ orders are not missed if there is a problem.

Message ordering doesn’t matter much here because the coffee makers often make batches of the same drink. Scalability is not as important either since queues are restricted to each Starbucks location.

The Starbucks queues can be implemented in a database table. The diagram below shows how it works:

When the cashier takes an order, a new order is created in the database-backed queue. The cashier can then take another order while the coffee maker picks up new orders in batches. Once an order is complete, the coffee maker marks it done in the database. The customer then picks up their coffee at the counter.

A housekeeping job can run at the end of each day to delete complete orders (that is, those with the “DONE status).

For Starbucks’ use case, a simple database queue meets the requirements without needing Kafka. An order table with CRUD (Create-Read-Update-Delete) operations works fine.

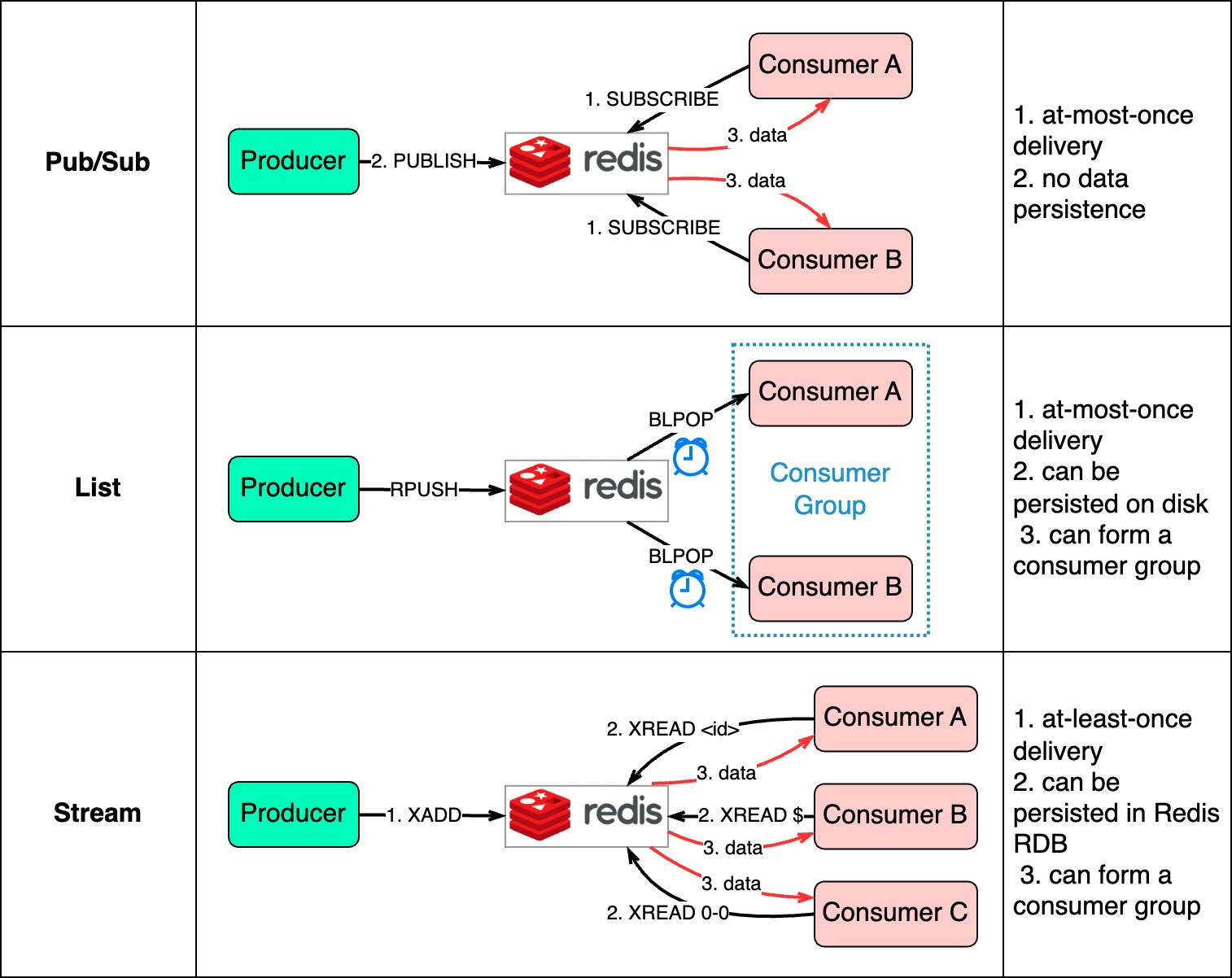

Redis-Backed Queue

A database-backed message queue still requires development work to create the queue table and read/write from it. For a small startup on a budget that already uses Redis for caching, Redis can also serve as the message queue.

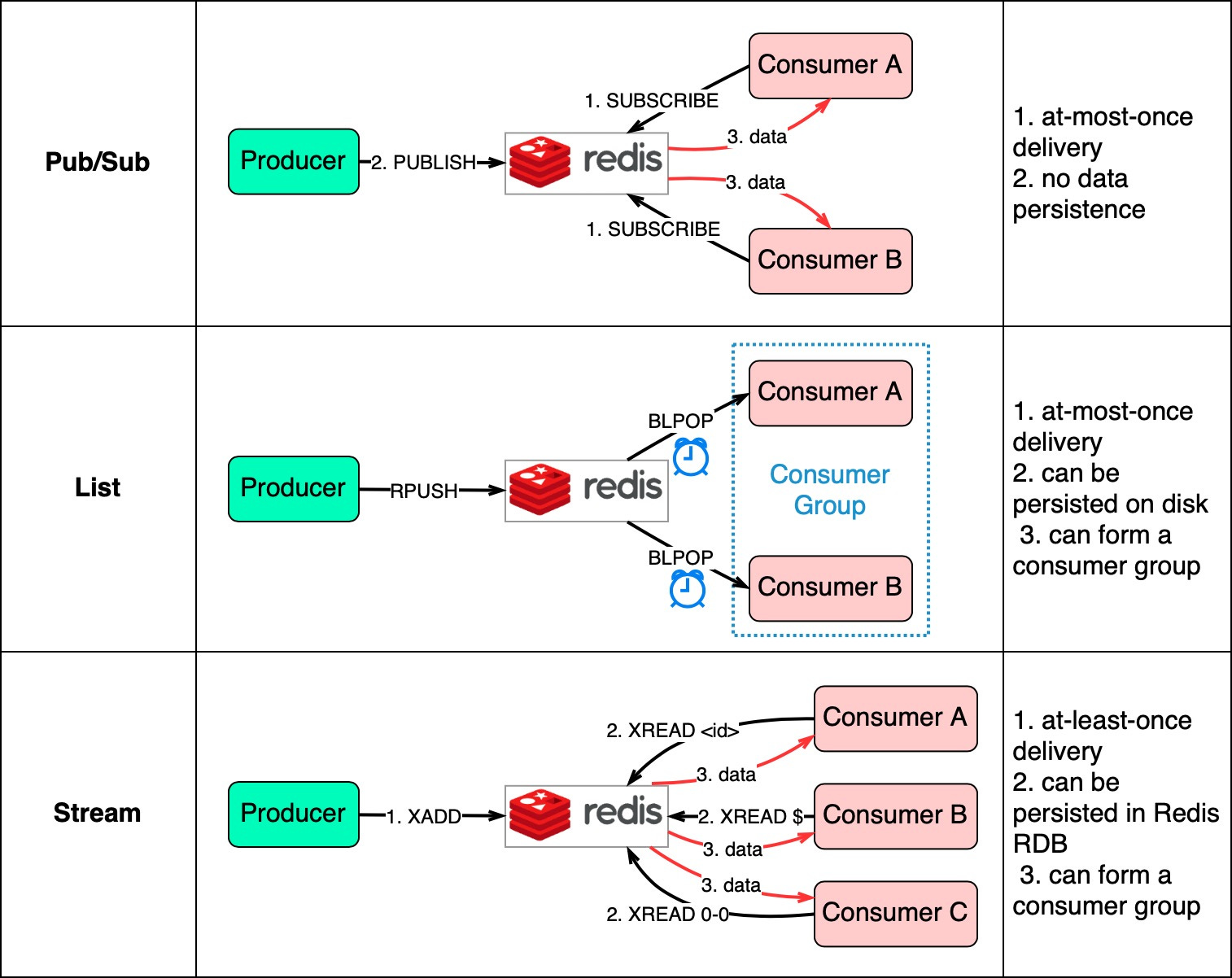

There are 3 ways to use Redis as a message queue:

Pub/Sub

List

Stream

The diagram below shows how they work.

Pub/Sub is convenient but has some delivery restrictions. The consumer subscribes to a key and receives the data when a producer publishes data to the same key. The restriction is that the data is delivered at most once. If a consumer was down and didn’t receive the published data, that data is lost. Also, the data is not persisted on disk. If Redis goes down, all Pub/Sub data is lost. Pub/Sub is suitable for metrics monitoring where some data loss is acceptable.

The List data structure in Redis can construct a FIFO (First-In-First-Out) queue. The consumer uses BLPOP to wait for messages in blocking mode, so a timeout should be applied. Consumers waiting on the same List form a consumer group where each message is consumed by only one consumer. As a Redis data structure, List can be persisted to disk.

Stream solves the restrictions of the above two methods. Consumers choose where to read messages from - “$” for new messages, “<id>” for a specific message id, or “0-0” for reading from the start.

In summary, database-backed and Redis-backed message queues are easy to maintain. If they can't satisfy our needs, dedicated message queue products are better. We'll compare two popular options next.

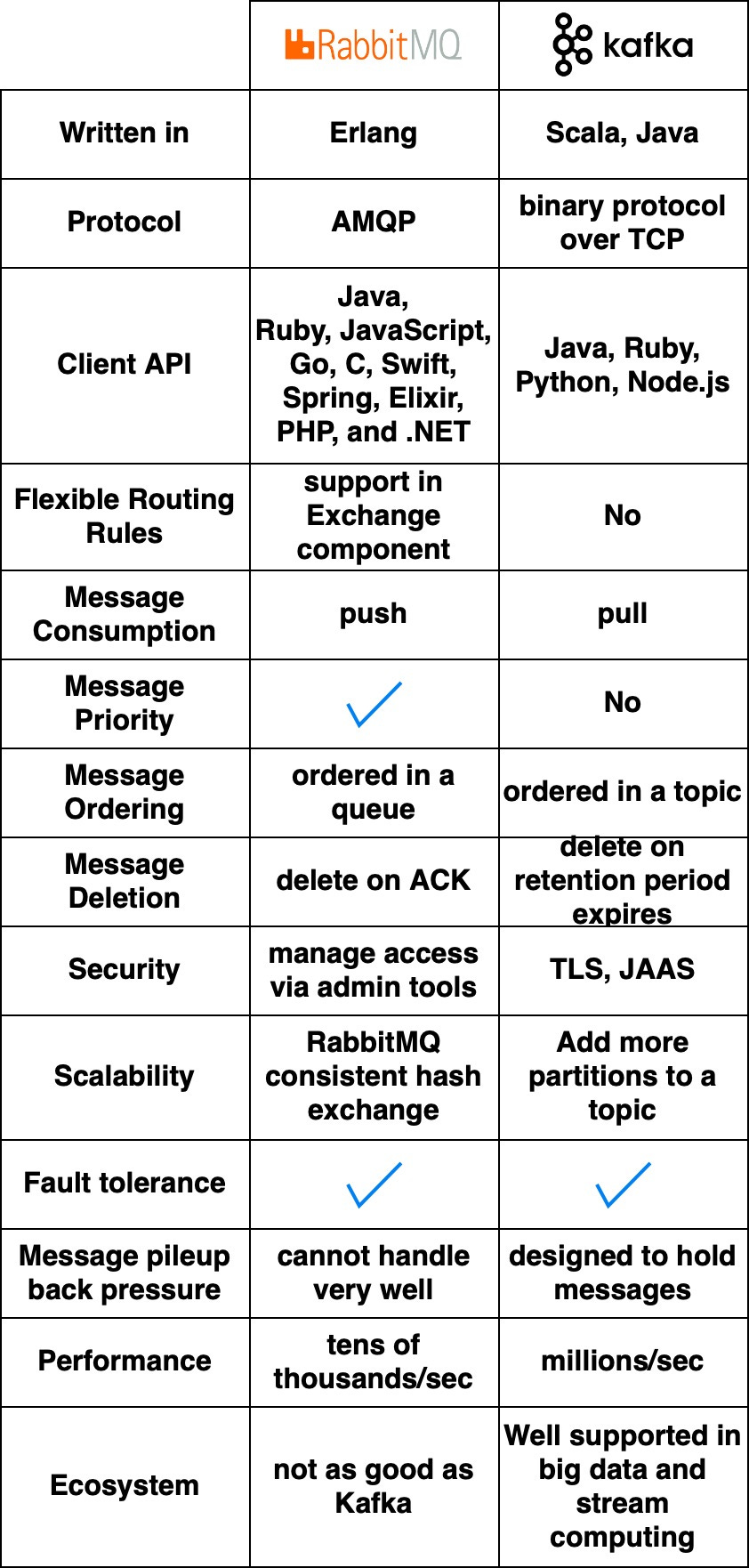

RabbitMQ vs. Kafka

For large companies that need reliable, scalable, and maintainable systems, evaluate message queue products on the following:

Functionality

Performance

Scalability

Ecosystem

The diagram below compares two typical message queue products: RabbitMQ and Kafka.

How They Work

RabbitMQ works like a messaging middleware - it pushes messages to consumers then deletes them upon acknowledgment. This avoids message pileups which RabbitMQ sees as problematic.

Kafka was originally built for massive log processing. It retains messages until expiration and lets consumers pull messages at their own pace.

Languages and APIs

RabbitMQ is written in Erlang which makes modifying the core code challenging. However, it offers very rich client API and library support.

Kafka uses Scala and Java but also has client libraries and APIs for popular languages like Python, Ruby, and Node.js.

Performance and Scalability

RabbitMQ handles tens of thousands of messages per second. Even on better hardware, throughput doesn’t go much higher.

Kafka can handle millions of messages per second with high scalability.

Ecosystem

Many modern big data and streaming applications integrate Kafka by default. This makes it a natural fit for these use cases.

Message Queue Use Cases

Now that we’ve covered the features of different message queues, let’s look at some examples of how to choose the right product.

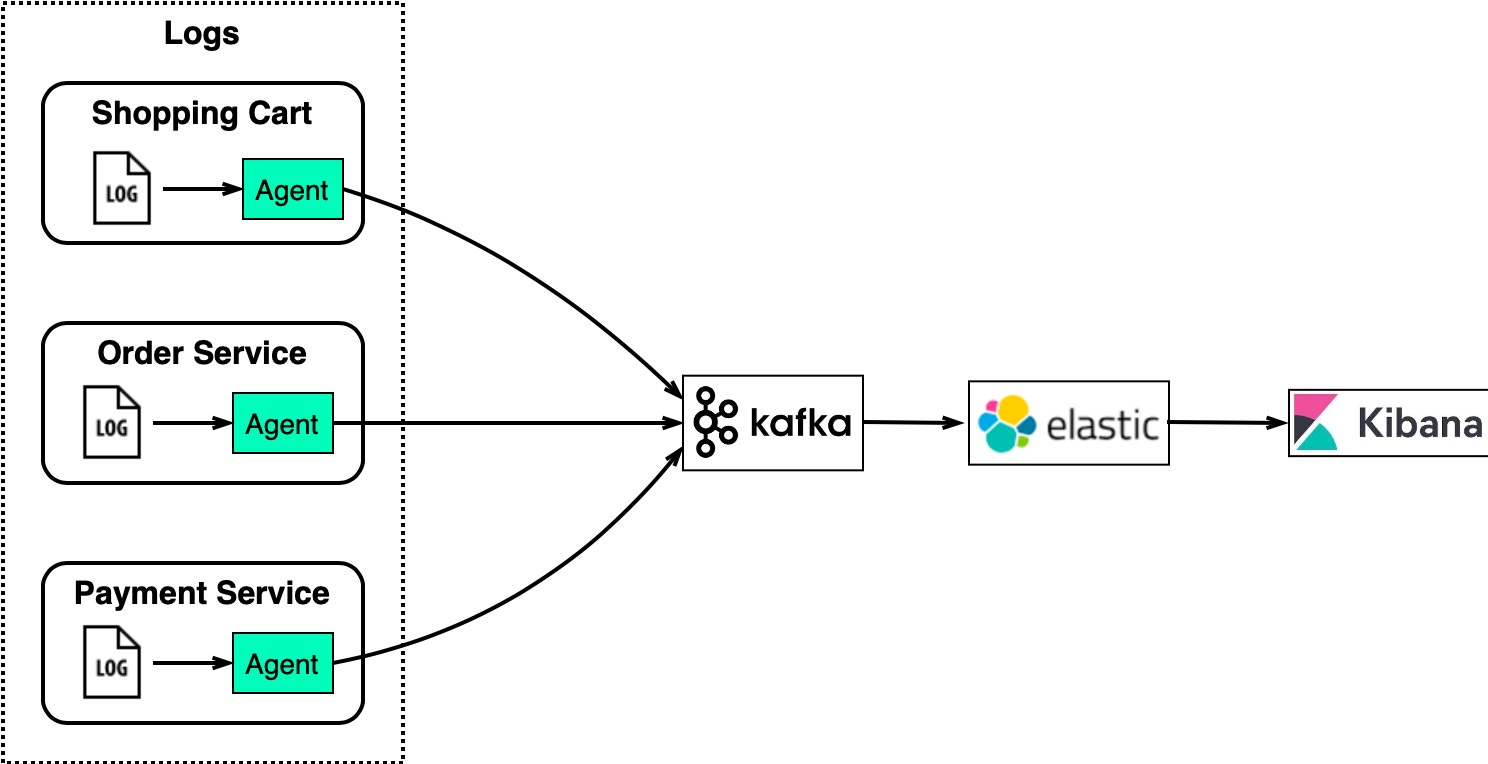

Log Processing and Analysis

For an eCommerce site with services like shopping cart, orders, and payments, we need to analyze logs to investigate customer orders.

The diagram below shows a typical architecture uses the “ELK” stack:

ElasticSearch - indexes logs for full-text search

LogStash - log collection agent

Kibana - UI for search and visualizing logs

Kafka - distributed message queue

Keep reading with a 7-day free trial

Subscribe to

ByteByteGo Newsletterto keep reading this post and get 7 days of free access to the full post archives.A subscription gets you:

An extra deep dive on Thursdays Full archive Many expense it with team's learning budget Like

Comment

Restack

© 2023 ByteByteGo

548 Market Street PMB 72296, San Francisco, CA 94104

Unsubscribe

by "ByteByteGo" <bytebytego@substack.com> - 12:50 - 17 Aug 2023 -

Forward Thinking on the recipe for Asia’s success story with Justin Yifu Lin

Start from what you have New from McKinsey Global Institute

Forward Thinking on the recipe for Asia’s success story with Justin Yifu Lin

Start from what you have Prefer audio? Listen to the podcast, and explore past episodes of the Forward Thinking podcast. Subscribe via Google Podcasts, Apple Podcasts, Spotify, Stitcher, or Amazon Music.

This email contains information about McKinsey's research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to our McKinsey Global Institute alert list.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Global Institute" <publishing@email.mckinsey.com> - 12:39 - 17 Aug 2023 -

Participate in our Capture the Flag Challenge happening 22 - 23 August

Schneider Electric

Boost your skills in cybersecurity!Schneider Electric is organising a jeopardy-style Capture The Flag (CTF) competition at Operational Technology Cybersecurity Expert Panel (OTCEP) Forum 2023 , and we would like to invite you to join!

Boost your skills in cybersecurity!Schneider Electric is organising a jeopardy-style Capture The Flag (CTF) competition at Operational Technology Cybersecurity Expert Panel (OTCEP) Forum 2023 , and we would like to invite you to join!

Day 1: 22 August, 09:00 - 16:00 SGT

Day 2: 23 August, 09:00 SGT - 13:00 SGT

There will be some challenges on ICS/OT, Reverse Engineering, Thick Client, Mobile Application, and so on. These challenges range in difficulty from intermediate to expert level.

Anyone can participate but if you have some basic understanding of networking, programming or Linux command line, this competition is for you!

Secure your spot now and experience the thrill of creative problem-solving by registering now! Ace the challenge and be rewarded!Complete the CTF challenges and rise up the scoreboard. Exciting prizes await for top 3 leaders of the scoreboard!

Ace the challenge and be rewarded!Complete the CTF challenges and rise up the scoreboard. Exciting prizes await for top 3 leaders of the scoreboard!

(Up to $5,950 SGD worth of prizes)+ Lifecycle Services From energy and sustainability consulting to optimizing the life cycle of your assets, we have services to meet your business needs. Schneider Electric

46 Rungrojthanakul Building. 1st, 10th, 11th Floor, Ratchadapisek Road. Huaykwang

Bangkok - 10310, Thailand

Phone +662 617 5555© 2023 Schneider Electric. All Rights Reserved. Schneider Electric is a trademark and the property of Schneider Electric SE, its subsidiaries and affiliated companies. All other trademarks are the property of their respective owners.

by "Schneider Electric" <reply@se.com> - 04:02 - 17 Aug 2023 -

Feria de Seguridad ESS+ Attendees list 2023

Dear Exhibitors,

Feria de Seguridad ESS+ 2023 - attendees list is available now at a discounted price.

Could you let me know if you want to receive the Attendee List by emails?

You can use this list for your booth invitation, pre-show marketing campaigns, and appointment setting. Easy tracking, quick response, global reach, targeted marketing, ROI, email fosters long-term relationships, and increased sales.

Interested — just reply back as “Send Counts, Cost"

Regards,

Adrian Gomez

(Events & Tradeshow Specialist)

by "Adrian Gomez" <adrian.gomez@globistictec.com> - 10:30 - 16 Aug 2023 -

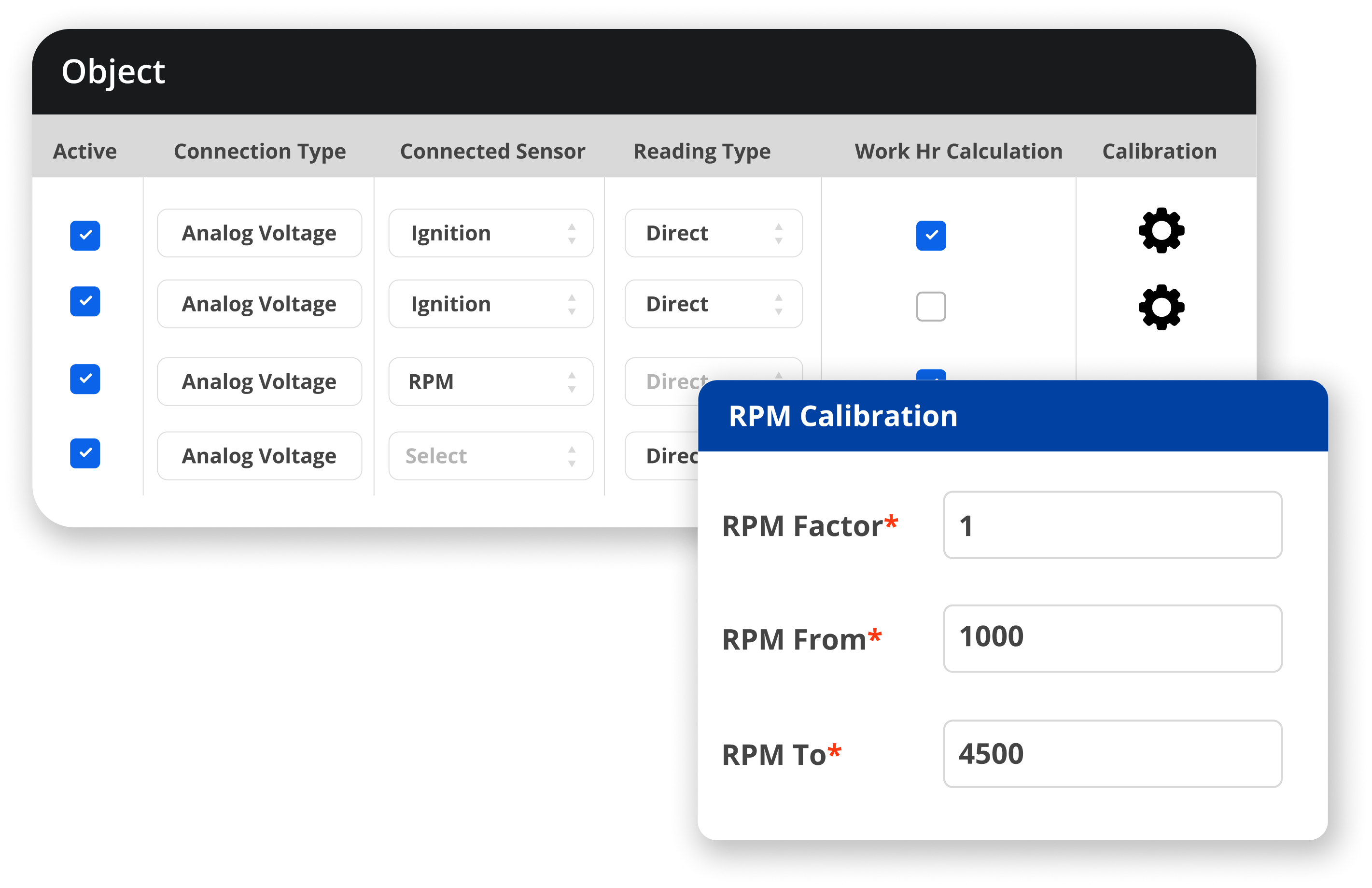

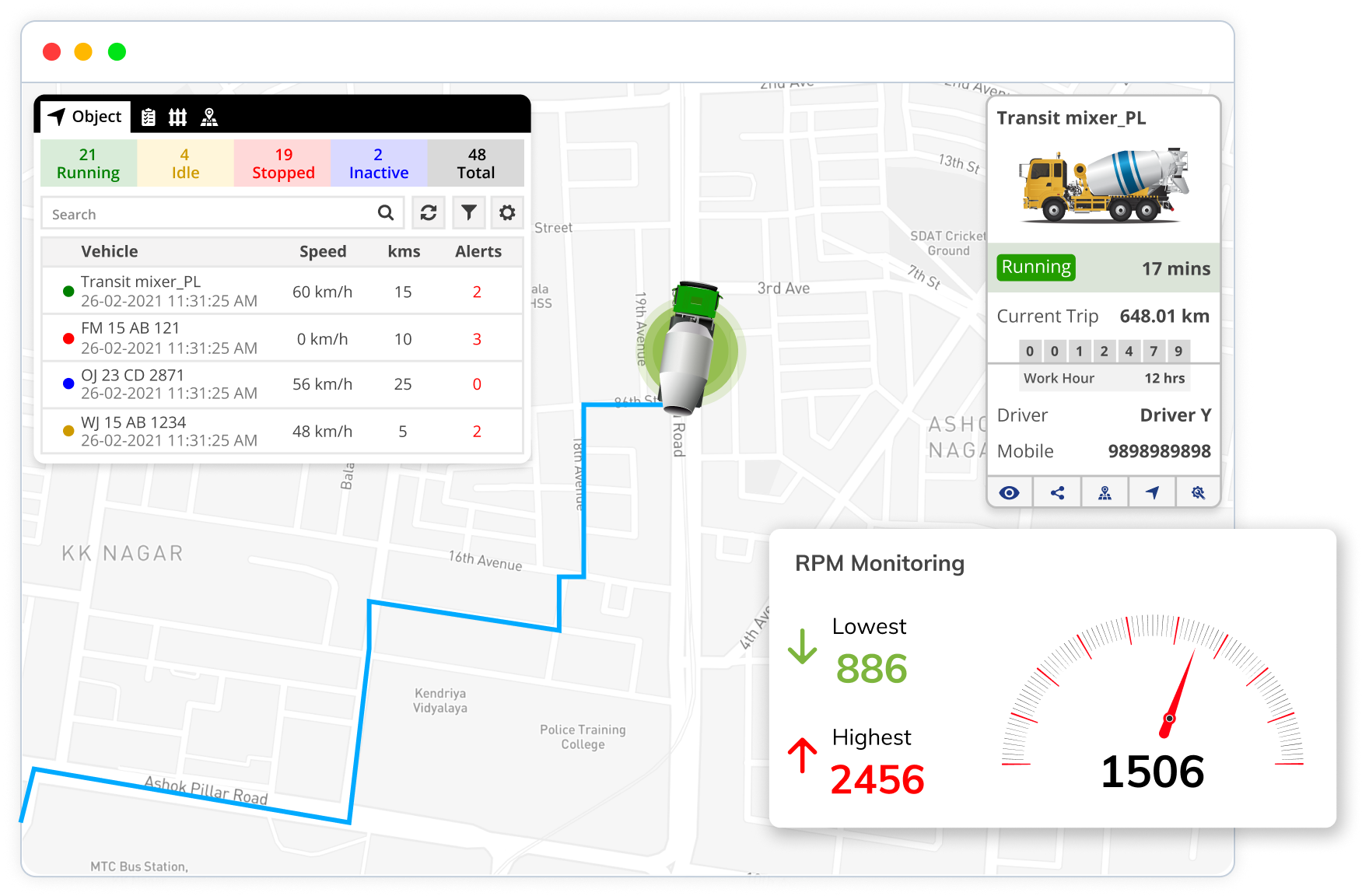

Optimize Fleet Efficiency with Advanced RPM Monitoring

Optimize Fleet Efficiency with Advanced RPM Monitoring

The deeper unfoldings of our RPM monitoring approach and its impact on operational efficiency and vehicle performance.

The deeper unfoldings of our RPM monitoring approach and its impact on operational efficiency and vehicle performance.

Find out what makes our software stand out from the crowd

Customizable RPM Threshold

Empower fleet managers with the flexibility to set specific RPM limits or ranges based on individual preferences, vehicle types, or driving conditions.

Real-Time Insights at Fingertips

Access real-time RPM data for every vehicle in the fleet, right from your fleet management software.

Insightful Reports and Instant Alerts

Harness RPM Monitoring to steer fleet towards success with proactive decisions, real-time alerts, and customizable reports for proven performance enhancements.

Empower your clients with precision-powered RPM Monitoring

Uffizio Technologies Pvt. Ltd., 4th Floor, Metropolis, Opp. S.T Workshop, Valsad, Gujarat, 396001, India

by "Sunny Thakur" <sunny.thakur@uffizio.com> - 08:00 - 16 Aug 2023 -

Your best customer may be the one you already have

Re:think

Companies can grow with existing customers

ON EXPERIENCE-LED GROWTH

Focusing on existing customers to unlock growth

Harald FanderlMany established companies grappling with competition focus on new customer acquisition to drive growth. But, in fact, focusing on existing customers can better optimize the current business and lay the foundation for future growth.

Experience-led growth, a strategy anchored around the goal of creating great customer satisfaction, also leads to better employee satisfaction and performance. Why?

There are several reasons: if companies focus on customers and their experiences, they make them happier, and because customer journeys go across various silos in organizations, employees can collaborate more and employee satisfaction increases as a result. Higher customer satisfaction and employee performance translates into better financial results and unlocks growth. To make up for the loss of one existing customer, companies have to acquire three new customers. And 80 percent of the value creation achieved by successful growth companies comes from their core business—namely, generating new revenue from existing customers.

Creating a harmonized, seamless customer journey for existing customers can cost significantly less than acquiring new customers. Customers who are more satisfied typically have fewer questions and therefore cost less to maintain, and the likelihood of retaining satisfied customers is 20 to 30 percent higher than if customers are less satisfied. Our research shows that over time, leaders who focus on customer experience achieve not only higher shareholder returns but also up to two times higher revenue growth than those whose customers are not as happy.

This is more critical now than ever because incumbent companies are increasingly reaching a saturation phase. Growth is really slowing down for some, so doubling down on customer orientation can be a great source of finding adjacent areas to grow into. Also, with competition and new solutions being generated from start-ups at a fast pace, it’s important for incumbents to rethink their business models. Focusing more on existing customers is one way to unlock untapped potential.“To make up for the loss of one existing customer, companies have to acquire three new customers.”

One experience-led growth tactic that is working really well these days is for companies to set up a win room that brings together all the important departments in an organization to drive customer acquisition, retention, and operational excellence. With clients in energy, insurance, telecom, and more, we have been successful in establishing experience-led growth as a theme, creating complete transparency between different groups and a better shared understanding of the metrics that drive retention, cross-selling, and growth because they’re in a win room together.

At one energy company in Europe, there were eight or nine floors with roughly 100 people responsible for different parts of the customer acquisition journey all scattered around in a building. We put them all together on one floor. When employees would walk onto this floor each day, they would look up and see numbers with the sales targets of the day, week, month, and year. They could see how they were performing as a complete team. With that information, the analytics team, the marketing team, and the digital team were able to overachieve their sales targets. This led to 20 to 30 percent greater growth beyond their already high ambitions. Financial performance, customer satisfaction, and employee satisfaction measurements over two years showed that all of them were up. It demonstrates what can be achieved with pragmatic approaches across all sectors and industries.

Another important element for successful experience-led growth is ambitious company leadership. It starts in the executive suite, where an engaged CEO can lead everyone to join forces. It’s not just the sales guy delivering the sales numbers; operations plays an important role too. Depending on the company structure, other lines of business need to be brought in as well. Having alignment in top management about how to activate a customer-led approach is absolutely crucial.

The final critical part of effective customer-centric growth is measurement. It’s not only important to measure customer satisfaction or the net promoter score (a metric for customer success) but to prioritize customer journeys. Then you can get to a place where you can predict customer satisfaction through analytics, by anticipating which segments will delight which customers and help retain them, or encourage them to buy more.

Most important, leaders need to be open in their organizations about their transformational journeys. Invite employees in, help them to overcome their mindset blockers, and encourage them to learn new skills. Don’t just say, “Be more customer oriented.” Identify skill gaps and encourage employees to tackle experience-led growth as part of their career development. There’s a strong positive company cultural dimension in bringing people together around their most important asset, the customer.ABOUT THE AUTHOR

MORE FROM THIS AUTHOR

UP NEXTRobin Riedel on the future of drone delivery

Delivery by drone has been touted as the next big thing, but it seems to be always on the cusp of a breakthrough. Today, start-ups, big retailers, and others are garnering investment, working through issues with regulators, and gaining more customer acceptance. Widespread drone delivery may be just around the corner.

This email contains information about McKinsey’s research, insights, services, or events. By opening our emails or clicking on links, you agree to our use of cookies and web tracking technology. For more information on how we use and protect your information, please review our privacy policy.

You received this email because you subscribed to our McKinsey Quarterly alert list.

Copyright © 2023 | McKinsey & Company, 3 World Trade Center, 175 Greenwich Street, New York, NY 10007

by "McKinsey Quarterly" <publishing@email.mckinsey.com> - 02:29 - 16 Aug 2023